Mini Loans

Personal

loans for

kicking goals

Low rates starting from 9.19% p.a. (comparison rate from

10.58% p.a.)

with money in your bank account in as little as

60 minutes.

Won’t impact your credit score!

Won’t impact your credit score!

Estimate your repayments

Find out how much your repayments and interest rate could be with our calculator.

Estimated monthly repayments

$910.72

Example interest rate

9.19% p.a.

Comparison rate

10.58% p.a.

Total charges

$1,857.28

Total repayments

$21,857.28

It won’t affect your credit score!

Mini Loans

How to get a mini loan?

At MoneyMe, we believe that we are your best choice for any type of loan, whether large or mini loans. With an up-to-date Australian Credit Licence, MoneyMe is a trusted, responsible money lender. We offer mini loans online for up to $50,000 with no asset security, low-interest rates, and competitive comparison rates.

As the go-to money lender of Gen Now in Australia, we allow people to manage their unsecured loans online, such as small personal loans and renovation loans. We offer a fast, hassle-free alternative to traditional credit providers.

We provide competitive interest rate ranges, regular repayments at variable amounts, and flexible repayment terms, including no early closing fees.

When it comes to mini loans, MoneyMe offers the following benefits:

- We offer personal mini loans with lower interest rates than other loans with banks (for unsecured loans).

- Our online application process for our mini finance loan is quick and easy.

- Money can be in your savings account the same day (for applications received before 5 pm Sydney time).

- We offer flexible debit and debts repayment plans for small bank loans that do not charge early exit fees.

With MoneyMe, you can apply for a mini loan quickly and easily. You may never have to speak with a representative. You don’t need a personal loan broker either. We need read-only access to your bank records and credit report to expedite your online application.

Before applying for an easy online mini loan, you will need to know how much you will be borrowing. Whether you’re looking for a short-term loan to upstart your new business project or a variable rate personal loan to help meet the conditions for financing your car, we offer both easy and mini loans.

Comparing quick personal loans in Australia is a good idea before choosing a lender. You can compare interest rates and other charges, such as early termination fees. To help you with the assessment of your mini loan, you can visit our site and use our personal loan calculator to find costs and the best loan terms for your specific situation.

At MoneyMe, when you choose us for your mini loan, we don’t charge you unnecessary fees such as an early termination fee because we value your ability to pay on time. Our mini loans are also unsecured, meaning we don’t ask for collateral or any assets to be listed under your mini financial services.

Our services are centred around the concept of responsible lending, which is why we also reassess your MoneyMe credit rating after a successful loan repayment. This is perfect for those with low credit scores as it allows you to receive better rates and value the next time you apply for a mini loan with us.

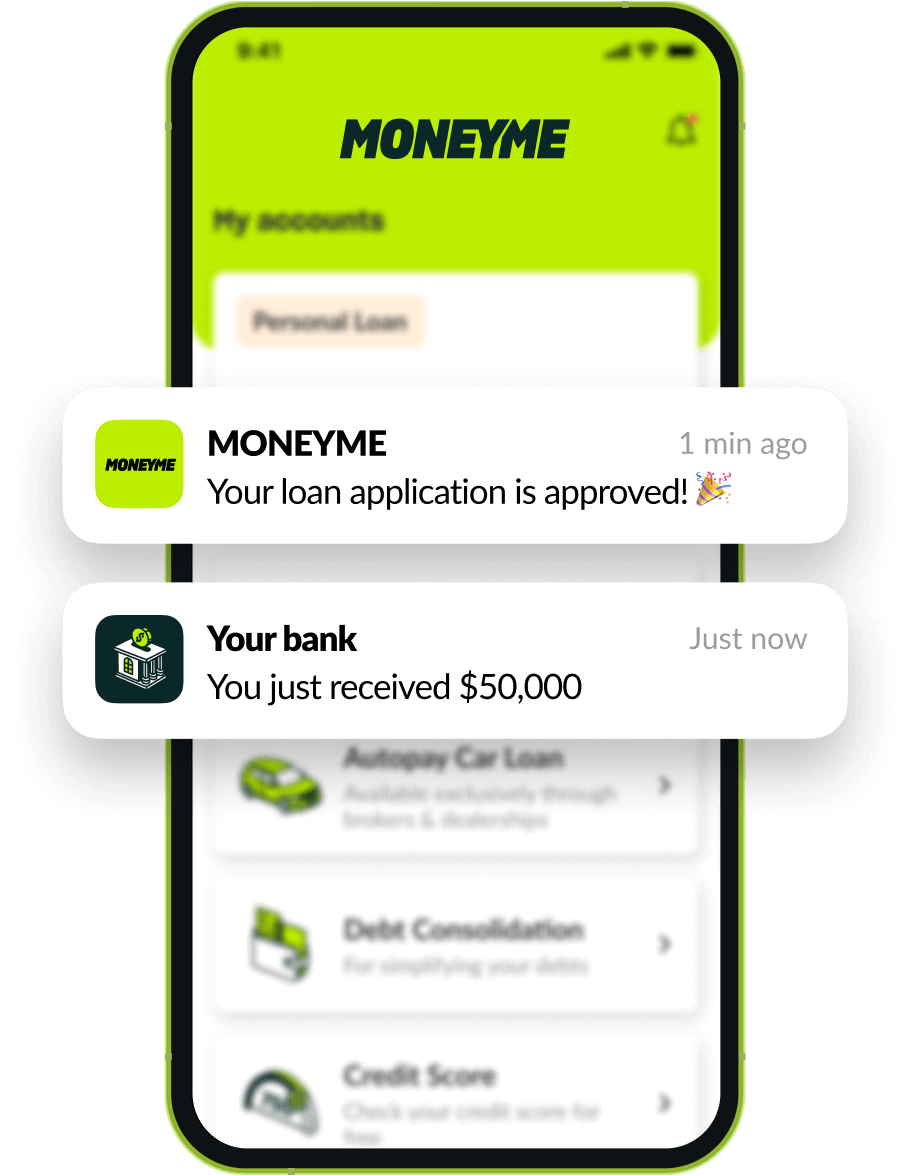

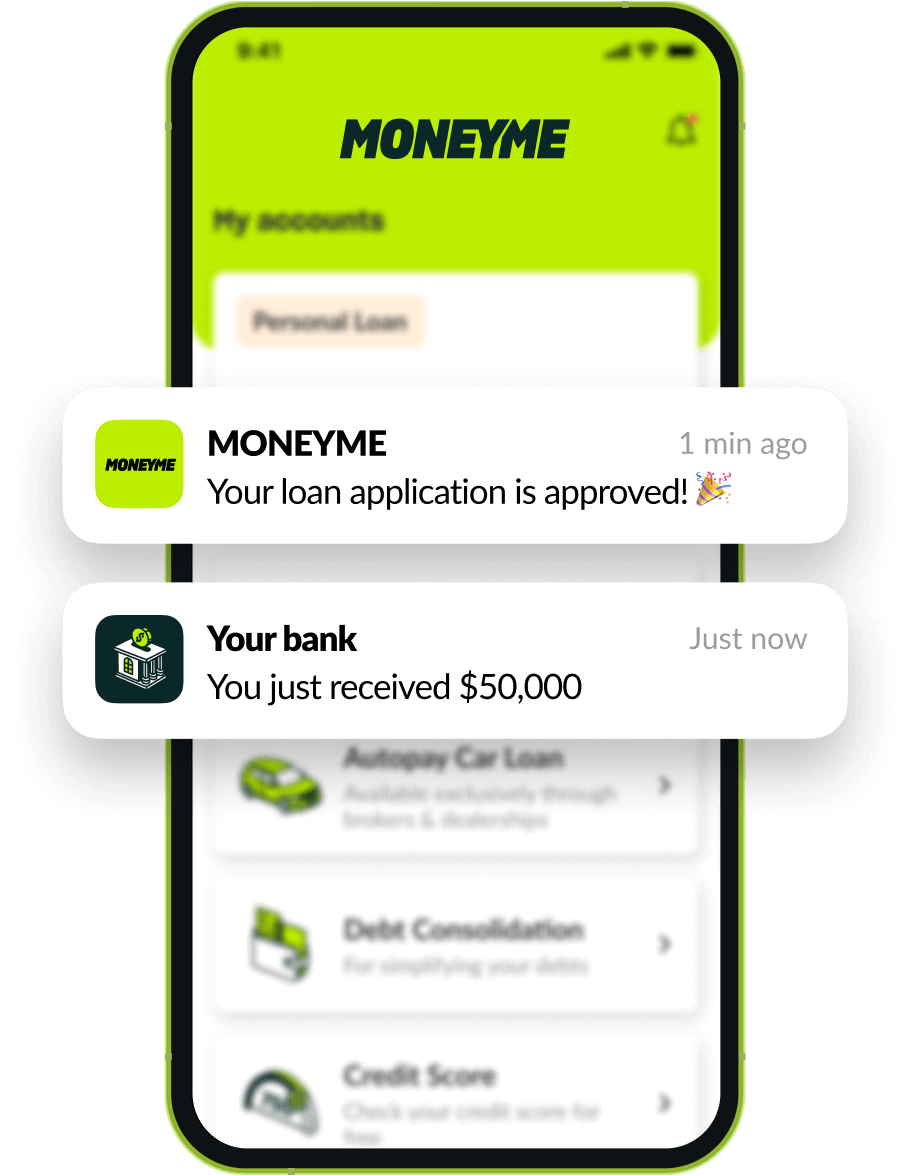

If you apply for your mini loan during business hours, we often give our approval within minutes. After your loan is approved, the cash you need will be in your bank account the same day and sometimes within minutes.

What are you waiting for? Go to our website or download our MoneyMe app to begin your responsible lending journey today!

How to get an instant mini loan?

You can easily get an instant mini loan from us here at MoneyMe, the new generation of money lenders.

MoneyMe provides fast approvals when customers need credit given that we are a comprehensive, fully online service. We offer a range of loans online, from finance loans to cash loans Australia, and it only takes five minutes to apply for an instant mini loan of up to $50,000.

All Australians can apply for our credit, regardless of their credit history. Due to our dedication to your finances, our company does not operate an expensive branch office in Chatswood or North Bondi. Instead, we provide cash instant mini loans to customers looking for fast credit solutions through an online mini loan platform powered by the latest technology.

No phone call or paperwork is necessary when you apply for cash or bond loans NSW or anywhere in Australia with us. Everything is submitted online, which is convenient for you.

MoneyMe is dedicated to making it easier to apply for mini loans. You will be asked to provide your online banking details, and we will receive read-only access to your statement, allowing us to verify your income and expense data.

In addition to speeding up our application process, we have been able to speed up our approval process so you can receive your funds as soon as possible. Any fast cash loan applicant can receive their approval and funds the day they apply. We take our same-day loan commitment seriously.

Aside from giving yourself greater cash flow flexibility, interest-free small loans can also give you a bit of breathing room, help you prepare for the future, and cover unforeseen expenses.

MoneyMe can help you get fast cash at a competitive rate. We offer mini loans starting at 6.25% per year (comparison rate 7.25% p.a.), and you choose the term that works for you. Take advantage of our interest-free payment plans to repay your loans with ease.

Consider how much you would like to borrow before you begin your application. As we offer personal mini loans up to $50,000, take into account the different factors that may affect your loan amount. At MoneyMe, we extend credit only to those customers we believe will pay it back comfortably.

Learn more about our responsible and affordable money lending services on our website or mobile app and apply for a small loan finance today!

What is a personal loan?

A personal loan is money borrowed over nominated terms from 3 to 5 years. Your financed amount is repaid in small, variable loan repayments regularly spaced over the loan term and the total cost of the loan should be clearly shown in your finance offer before you sign your lending contract. Your repayments should also be outlined in your loan offer so you know how much you repayments will be, when they will be direct debited and whether a payment fee or service fee applies.

Types of personal loans include both secured and unsecured. An unsecured loan is a type of finance that does not require asset security and all loans from MoneyMe are offered as unsecured finance. You do not require asset security to be eligible for any of our lending options.

Whatever you need money for, we can help. We offer customers unsecured loan options including car loans, travel overseas, and consolidation debt loans with competitive variable interest rates. Variable interest rate refers to the interest charged over the course of your finance. A variable interest rate may change but a variable interest rate remains the same. MoneyMe offers variable interest rate finance options. Consolidating your debt, for example, into a single loan amount could offer you significant cost savings like reducing your total interest payable across multiple debts.

Enjoy competitive interest rate ranges, regular repayments at a variable amount and flexible repayment terms like not exit fee charged when you choose to close out your balance ahead of schedule.

MoneyMe is a responsible money lender with a current Australian Credit Licence. We offer online personal loans requiring no asset security for up to $50,000 with competitive comparison rates and interest rate offers.

How to get a personal loan

To be eligible for variable rate finance from MoneyMe, you must be at least 18 years of age, currently employed and a permanent resident in Australia. To apply, simply complete and submit our online application form. It takes just a few minutes and there is no application fee.

Our online application form will ask you standard lending questions like details of your income, mortgage payments for home loans or rental payments if you're a renter, as well as any other bills and debts that you currently have. You'll be asked to input your ideal borrowing amount and what the purpose of your loan is such as whether it is for car finance, etc.

As part of our standard practice, your credit report will be accessed to help us understand what kind of credit history you have. Your credit assessment is just one part of your application and all applications are thoroughly assessed. Don't worry if your credit report isn't quite as good as you'd like it to be. We understand that your credit history does not present a full picture of your financial status. Your credit file, however, will likely affect the total cost of the loan that you apply for. Weaker credit files will usually attract a higher unsecured personal loan interest rate. Remember that you can reduce the amount of loan repayments that you make by paying out your balance ahead of time. We do not charge fees for repaying your unsecured loan balance early. Ensure that you take this into account when you compare personal loans.

Approvals are often received within minutes when you apply for your finance amount during our business hours. Once your loan amount is approved, the cash you need will be in your bank account on the same day, and within minutes in some cases.

How to apply for a personal loan

Applying for a personal loan with MoneyMe is quick and simple.

-

Let us know how much money you’d like to borrow and what kind of repayments you'd like to make.

-

Complete your personal information, bank account details, and valid email address.

-

In a few minutes you will receive a decision. Once approved, you could receive cash within minutes.

Personal loans approved fast!

There are times in life when a little extra money at the right time would really come in handy. MoneyMe loans are the safe, hassle-free way to get the cash you need at competitive interest and low fees. Enjoy fast approvals on every type of finance from loans to purchase a new car to loans for investment purposes and more. When you need fast cash at the right loan interest rate, apply online with us. You could be approved for an unsecured loan of $30,000 in minutes.

Our customers

LOVE us

Mini Loans

Jayceenemo

Aug 09, 2023

Aug 09, 2023

Fast, fair and easy. Very happy customer. Happy to get another loan in the future from MONEYME.

BGC

Jun 13, 2023

Jun 13, 2023

Simple process, easy to follow application, quick response time and good support.

Brad

May 31, 2023

May 31, 2023

I was impressed with how easy and quick the application was. Very happy with their customer service, and the app is very convenient.

4.6/5

Transparent and

simple pricing

Interest rate

(variable)

9.19

%

p.a.

to 23.99

%

p.a.

Comparison rate

10.58

%

p.a.

to 26.58

%

p.a.

Establishment fee

(Direct applications)

$395 for loans between $5,000 and $15,000

$495 for loans between $15,001 and $50,000

Monthly fee

$10

Loan terms

Minimum 3 years

Maximum 5 years

Early exit fees

None

Ready to get

started?

Won’t impact your credit score!

Won’t impact your credit score!