About MONEYME

Click on a category to see options

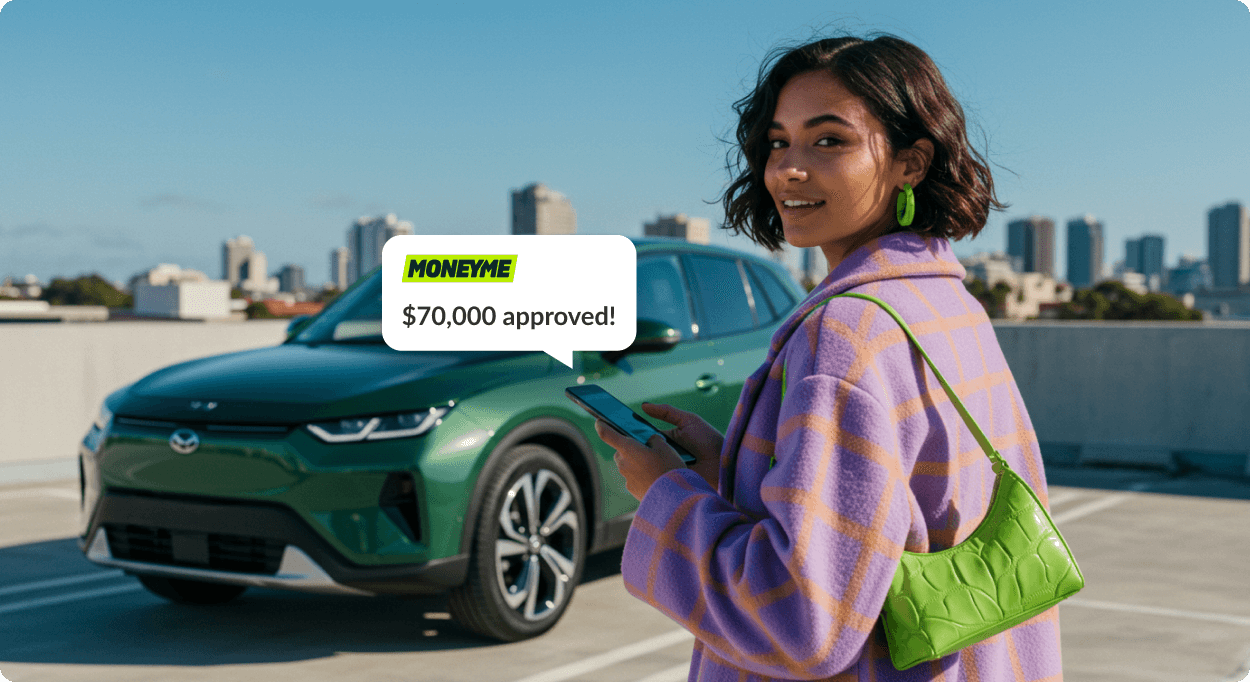

Unsecured car loans up to $70,000

See it. Buy it. Drive it.

Drive away same-day with our bank-beating rates, speed & service.

p.a.

p.a.

Takes minutes with no impact to credit score

- Showing results for

Car Loan Finder

Simple terms.

No hidden fees.Simple terms. No hidden fees.

With no impact to your credit score

Start with an obligation-free quote

There's no paperwork required and no impact to your credit score. Get all the important information you need before you apply.

Personalised rate

Check your rate and repayments before you apply

Borrowing power

Calculate the maximum amount you can borrow

Eligibility check

Confirm you are eligible before you apply

Same day loans

If you proceed with your quote, we offer funding in as little as 60 minutes

With no impact to your credit score

Low rates that

beat the banks

Get a better a deal with our bank-beating rates.

MONEYME

CommBank

ANZ

NAB

Westpac

Click here for important information on comparison rates. All rates are for variable rate loans, unless noted with an asterisk (*), which indicates a fixed rate loan. Comparison excludes short-term promotional rates. Last updated 02/02/2026.

Ready to get a quote?

Find out your rate and repayments in under 90 seconds

With no impact to your credit score

How our car loans work

Step 1

Start with a quote

No credit score impactGet a quote to find out how much you could borrow (up to $70,000) and your personalised rate. You can also view repayment options to help you budget.

Step 2

Get conditional approval

No credit score impactGet conditional approval by providing a few more details, like your income and expenses. No need to use the vehicle as security with our unsecured loan.

Step 3

Same-day funding

Accept your offer and we'll complete one final review. If everything looks good you could drive-away that day with funds in your account in as little as 60 minutes (even on weekends).

Car Loan Finder

Have you been browsing a car loan finder in search of a reliable financing provider? MONEYME is the answer. We are a premier online money lender guaranteeing a swift application process to help you borrow money to buy a car and get you on the road in no time.

Take advantage of our simple process to apply for our car loan deals and receive an outcome and funds in as little as 60 minutes!

How to find the best car loan?

Any car loan finder would tell you that good car loans have competitive interest rates and few recurring charges. The highest cost of a car loan is the interest rate. The difference between the interest rate of one lender and that of another can save you thousands of dollars. So it is important that you make a car finance comparison across different lenders using an online car loan finder.

An auto car loan can have either a fixed or variable interest rate. The former remains constant over the life of the loan, whereas the latter fluctuates based on a benchmark that changes periodically. MONEYME charges variable car finance interest rates on both our new car loan and used car loan.

It is essential to choose a suitable loan duration between one and five years according to your financial capacity. A shorter loan term entails larger repayments, but you pay less interest than a longer loan term. You should also choose a lender that gives you flexible repayment options.

MONEYME does not charge early-exit fees to customers who want to settle their balance in full before the end of the loan term. We want to protect your financial interest to get you on the track towards stability. That is why we only offer unsecured loans that rely on your ability to repay instead of requiring your assets as collateral. You never have to worry about losing your car or the roof over your head if you default on the loan. You can also count on us to only lend you money that you can realistically afford to repay. So stop scrolling through that online car loan finder and send an application today.

Do car loans affect my credit score?

Your credit score is a reflection of your ability to manage your finances effectively. It also gives an idea of how reliable you are at meeting debt obligations. So it is the first thing lenders consider when assessing your car loan application. The higher your credit score, the better your chances of getting the best car loan.

The information in your credit report is used to calculate your credit score. This document details your credit history spanning a specific period.

An enquiry is added to your credit report every time a lender obtains a copy of the document to evaluate your application. That means your credit score can decline if you shop around for credit or make multiple applications in a short time frame. Therefore, you should space out your loan requests to prevent your score from plummeting. Moreover, negative marks on your credit report, such as defaults and outstanding debts, can negatively impact your score.

You can ask any car loan finder, but there is no magic credit score that guarantees approval. You can still apply for auto financing if you have an average or below-average credit score since there are lenders that specialise in car loans for people with less-than-excellent credit. These lenders look beyond your credit history to determine if you qualify for a loan.

MONEYME takes into account a range of other factors in the process of evaluating your financial capacity. The extensive selection of credit solutions we offer enables us to meet the diverse requirements of our customers.

A significant benefit of taking out a car loan online is that it lets you improve your credit score over time. You can take advantage of the service to build a solid credit history so long as you stay on top of your repayment obligations. You can then leverage the higher score to qualify for more significant loan amounts.

How long does it take to get a car loan?

It takes around one to two days for traditional lending institutions to process a vehicle loan. There can be several factors that affect this estimate, such as documentation, credit history, and identity verification. The waiting time can be even longer for customers who don't have great credit since they are often required to submit additional documentation to substantiate their financial capacity.

MONEYME cuts the notorious inefficiencies of car loan applications with our innovative online solution. You can submit a personal car loan request in a matter of minutes and have the funds sent to your account on the same day!

MONEYME is known as one of the best alternatives to traditional lenders. You can forget about arduous phone calls with banks and credit unions – all we need is digital access to your most recent bank statements and your driver’s licence. We also have an active customer service team that you can contact for assistance throughout the application process.

Utilise our intuitive online interface to manage your credit accounts in one convenient platform. You can use it to track your car payments.

We recommend using our personal loan calculator to get repayment estimates for different interest rates and loan terms. You can use it to determine which terms and conditions are best for you.

Apply now!

Award-winning lender

Trusted by over 110,000 Aussies

MONEYME Reviews Average rating: 4.7, based on 4700 reviewsWith no impact to your credit score

Purpose-driven

and responsible

At MONEYME, we're not just here to provide low rate loans - we're here to make a difference. We believe in providing smart, responsible lending that keeps you financially on track, whilst doing good for the planet.

As a Certified B CorporationTM we're big on sustainability. We hold ourselves accountable to the high standards of the B Corp movement, supporting renewable energy projects, doing our part for the community, and striving towards a greener future.

Explore our impact

*This comparison rate is based on an unsecured variable rate personal loan of $30,000 for a term of 5 years. Rates displayed are for customers with an excellent credit history, where a $0 establishment fee applies. For other borrowers, an establishment fee of $395 or $495 will apply, based on loan amount. A $10 monthly fee applies to all personal loans. WARNING: This comparison rate is true only for the example given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate.