About MONEYME

Click on a category to see options

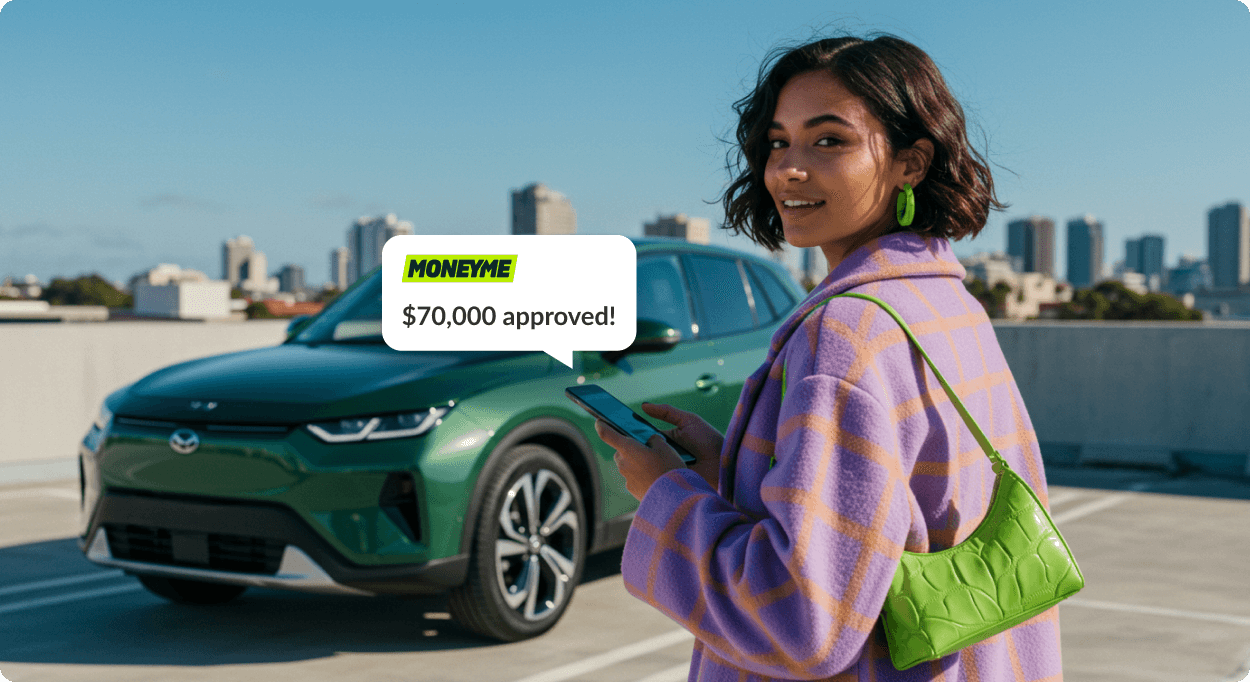

Unsecured car loans up to $70,000

See it. Buy it. Drive it.

Drive away same-day with our bank-beating rates, speed & service.

p.a.

p.a.

Takes minutes with no impact to credit score

- Showing results for

Chattel Mortgage Car Loan

Simple terms.

No hidden fees.Simple terms. No hidden fees.

With no impact to your credit score

Start with an obligation-free quote

There's no paperwork required and no impact to your credit score. Get all the important information you need before you apply.

Personalised rate

Check your rate and repayments before you apply

Borrowing power

Calculate the maximum amount you can borrow

Eligibility check

Confirm you are eligible before you apply

Same day loans

If you proceed with your quote, we offer funding in as little as 60 minutes

With no impact to your credit score

Low rates that

beat the banks

Get a better a deal with our bank-beating rates.

MONEYME

CommBank

ANZ

NAB

Westpac

Click here for important information on comparison rates. All rates are for variable rate loans, unless noted with an asterisk (*), which indicates a fixed rate loan. Comparison excludes short-term promotional rates. Last updated 16/10/2025.

Ready to get a quote?

Find out your rate and repayments in under 90 seconds

With no impact to your credit score

How our car loans work

Step 1

Start with a quote

No credit score impactGet a quote to find out how much you could borrow (up to $70,000) and your personalised rate. You can also view repayment options to help you budget.

Step 2

Get conditional approval

No credit score impactGet conditional approval by providing a few more details, like your income and expenses. No need to use the vehicle as security with our unsecured loan.

Step 3

Same-day funding

Accept your offer and we'll complete one final review. If everything looks good you could drive-away that day with funds in your account in as little as 60 minutes (even on weekends).

Chattel Mortgage Car Loan

Business owners can expand their business right when they feel ready for it through our chattel mortgage car loan, here at MONEYME. Every entrepreneur wants to grow their business fast, however, they don’t always have the funds to invest in new equipment like company cars. Some would have to save up for years before they can finally afford new transportation for their business to expand their service areas. Start-ups would have to wait even longer, especially since most of their expenses are fixed costs, leaving less room to save up for new assets.

This is why MONEYME offers fast online chattel mortgage car loan services – to help both established and new businesses secure funds to purchase the car they want, right when they need it.

What is a chattel mortgage car loan?

When businesses and self-employed individuals don’t have enough funds to purchase a vehicle with a one-time full payment, their next best option is to get a loan. Everyone knows that getting a loan means borrowing money from a financing institution but not many people know the types of transactions under a loan service. There are two basic types of transactions for loans: unsecured and secured transactions.

An unsecured loan requires no collateral which means borrowers or the people who want a loan can get the money without securing any asset to the lender. Unsecured loans are approved based on the borrower’s creditworthiness instead of their assets. Meanwhile, secured loans require borrowers to secure an asset to the lender. A chattel mortgage loan is a type of secured transaction.

The main difference between a chattel mortgage car loan and a simple car loan is that chattel mortgages refer to movable properties, such as mobile homes, jewellery, electronics, bonds, or stocks, that are used to secure a loan to get a car. The ‘chattel’ or movable property used to secure the loan doesn’t even have to be something the borrower already owns; oftentimes, the chattel for the loan will be the same vehicle that is being purchased using the loan. The creditor or the financing institution will then hold a lien over the chattel until the full amount is repaid.

What are the benefits of a chattel mortgage car loan?

Chattel mortgage car loan transactions are beneficial to both financing companies and the borrower. Generally, individuals and businesses who get chattel mortgages enjoy lower interest rates than other types of secured loans as well as more flexible payment structures. Because chattels are often properties that people don’t need on a daily basis – like construction equipment, for example – then they can get money for things that are not necessarily crucial to their everyday lives. In the case of using the vehicle being loaned as the chattel, business owners don’t have to touch their other business assets for the loan so the risk involved is much lower.

As for lenders, chattels are easier to obtain and sell, if the debtor ever fails to repay the loan.

How to apply for a chattel mortgage car loan?

Both individuals and businesses are eligible to get a chattel mortgage car loan, given that the vehicle that will be purchased will be used primarily for business use. In Australia, one of the main requirements for this type of car loan finance is that the vehicle purchased will be used for business at least 51% of the time. Other requisites for individuals who wish to get a chattel mortgage car loan include having an Australian Business Number (ABN) and being registered for the Goods and Services Tax (GST). Like other car loans, you need to have a clear credit history to prove your capability to service the loan.

MONEYME can make the process of getting a chattel mortgage car loan much easier with our digital financing solution. You can apply for the loan online by filling out the form which would only take a few minutes. To get estimates on your loan repayment, you can use our car lease calculator for convenience. You can loan any amount from $5,000 to $70,000 for terms between one to five years. The best part is that you can get approved within minutes and from there, you can manage everything from your iOS or Android device.

Getting a chattel mortgage car loan can be that simple and practical with MONEYME.

MONEYME is a digital financial services company that offers multiple car finance options including small car loans, second-hand car loans, self-employed car loans and even car repair financing. Individuals looking for a chattel mortgage for a car in Australia can depend on MONEYME to provide them with the right financial solution that suits their needs.

MONEYME offers loans with mortgage interest rates that are much lower than what the country’s four biggest banks charge its clients. Not only that but you can get your loan approved in a matter of minutes compared to the average week-long approval process of most chattel finance companies. This is all thanks to the fast and easy online registration for car loans that MONEYME offers. You can get the money in your account within the same day – that’s how hassle-free our car finance deals can be!

Adding more automotive assets to support your growing business can be fast, easy, and low-risk with MONEYME! We are the mortgage loan finance company of choice for growth-oriented entrepreneurs.

Award-winning lender

Trusted by over 110,000 Aussies

With no impact to your credit score

Purpose-driven

and responsible

At MONEYME, we're not just here to provide low rate loans - we're here to make a difference. We believe in providing smart, responsible lending that keeps you financially on track, whilst doing good for the planet.

As a Certified B CorporationTM we're big on sustainability. We hold ourselves accountable to the high standards of the B Corp movement, supporting renewable energy projects, doing our part for the community, and striving towards a greener future.

Explore our impact

*This comparison rate is based on an unsecured variable rate personal loan of $30,000 for a term of 5 years. Rates displayed are for customers with an excellent credit history, where a $0 establishment fee applies. For other borrowers, an establishment fee of $395 or $495 will apply, based on loan amount. A $10 monthly fee applies to all personal loans. WARNING: This comparison rate is true only for the example given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate.