About MONEYME

Click on a category to see options

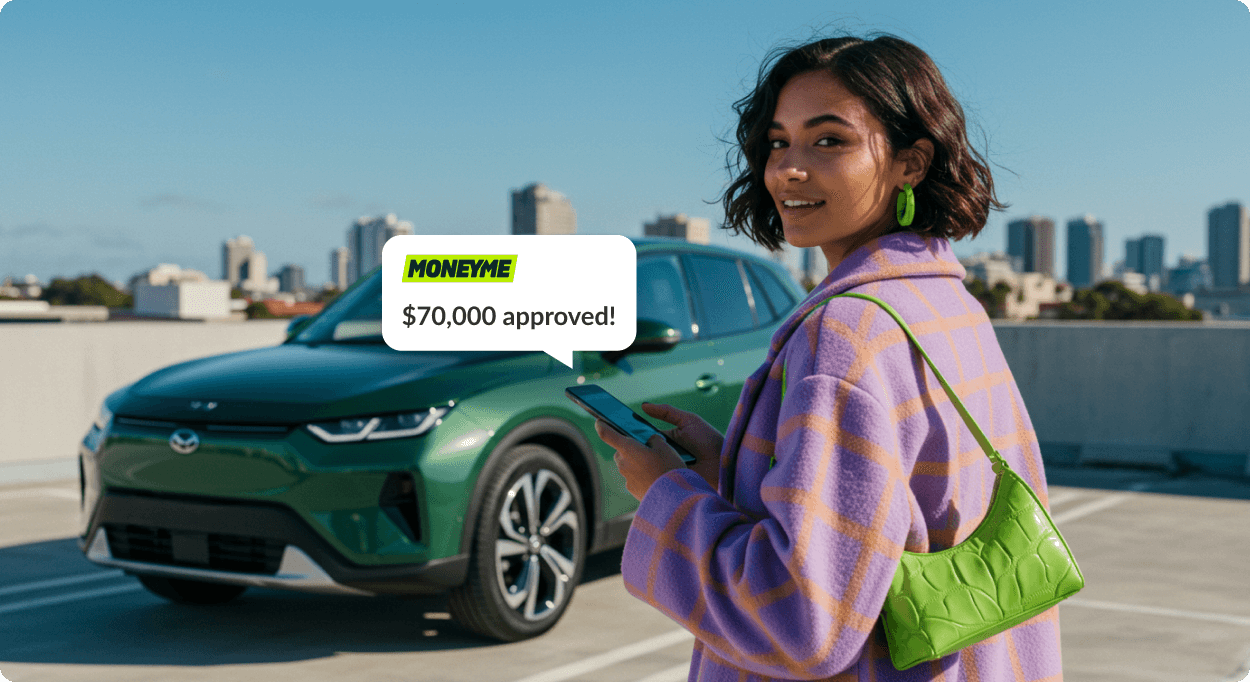

Unsecured car loans up to $70,000

See it. Buy it. Drive it.

Drive away same-day with our bank-beating rates, speed & service.

p.a.

p.a.

Takes minutes with no impact to credit score

- Showing results for

Car Loan Deals

Simple terms.

No hidden fees.Simple terms. No hidden fees.

With no impact to your credit score

Start with an obligation-free quote

There's no paperwork required and no impact to your credit score. Get all the important information you need before you apply.

Personalised rate

Check your rate and repayments before you apply

Borrowing power

Calculate the maximum amount you can borrow

Eligibility check

Confirm you are eligible before you apply

Same day loans

If you proceed with your quote, we offer funding in as little as 60 minutes

With no impact to your credit score

Low rates that

beat the banks

Get a better a deal with our bank-beating rates.

MONEYME

CommBank

ANZ

NAB

Westpac

Click here for important information on comparison rates. All rates are for variable rate loans, unless noted with an asterisk (*), which indicates a fixed rate loan. Comparison excludes short-term promotional rates. Last updated 16/10/2025.

Ready to get a quote?

Find out your rate and repayments in under 90 seconds

With no impact to your credit score

How our car loans work

Step 1

Start with a quote

No credit score impactGet a quote to find out how much you could borrow (up to $70,000) and your personalised rate. You can also view repayment options to help you budget.

Step 2

Get conditional approval

No credit score impactGet conditional approval by providing a few more details, like your income and expenses. No need to use the vehicle as security with our unsecured loan.

Step 3

Same-day funding

Accept your offer and we'll complete one final review. If everything looks good you could drive-away that day with funds in your account in as little as 60 minutes (even on weekends).

About MONEYME's car finance deals

Applying for car finance loans has never been simpler than with MONEYME. Our entirely online application and approvals process is the modern solution for getting funds quickly, allowing Australia to get on the road in record time in their own new cars.

With no hidden costs or early repayment fees, what you see is what you get with our car finance deals. We use the best in technology to deliver personalised quotes based on your financial situation. With our famously low interest rates, you can get the best deal possible to suit your budget.

Award-winning lender

Trusted by over 110,000 Aussies

With no impact to your credit score

How to apply for a car finance loan

Applying for a car finance deal is easy with MONEYME:

- Once you've found a great car deal, get an online quote in 90 seconds to see how much you could borrow and your personalised rate without impacting your credit score.

- If you’re happy with your rate and repayments, finish your online application with just a few extra details.

- If approved, we transfer the funds straight away. You could have the funds in as little as 60 minutes, giving you the chance to buy your great value car on the same day, even on weekends.

Purpose-driven

and responsible

At MONEYME, we're not just here to provide low rate loans - we're here to make a difference. We believe in providing smart, responsible lending that keeps you financially on track, whilst doing good for the planet.

As a Certified B CorporationTM we're big on sustainability. We hold ourselves accountable to the high standards of the B Corp movement, supporting renewable energy projects, doing our part for the community, and striving towards a greener future.

Explore our impact

*This comparison rate is based on an unsecured variable rate personal loan of $30,000 for a term of 5 years. Rates displayed are for customers with an excellent credit history, where a $0 establishment fee applies. For other borrowers, an establishment fee of $395 or $495 will apply, based on loan amount. A $10 monthly fee applies to all personal loans. WARNING: This comparison rate is true only for the example given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate.