About MONEYME

Click on a category to see options

Autopay for brokers and dealerships up to $150,000

Offer your clients market-leading car finance.

Bank beating rates, speed & service with application to settlements in 60 minutes, 7 days a week.

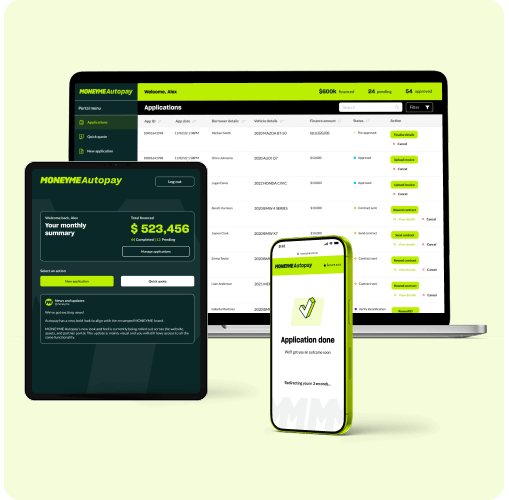

Fast. Digital. Seamless.

We've reimagined car finance to be fast, digital, and hassle-free.

Fastest settlement times you've ever seen

Loans fund almost instantly, 24/7, with our fastest loan in 2025 settlement in just 5 minutes. Your clients can drive away faster than ever.

Competitive rates that service a wide range of clients

Our risk-based pricing allows us to service a wide range of clients, both individual and commercial up to $150,000.

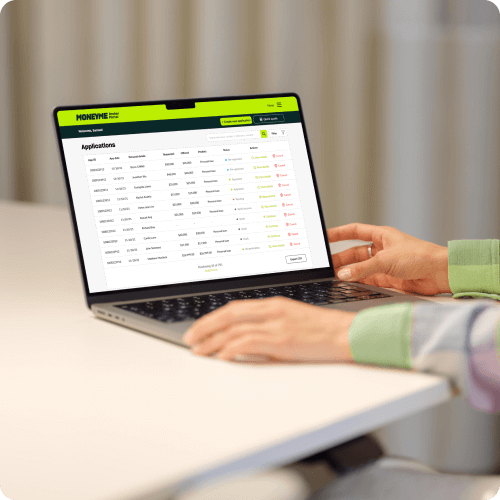

Super simple applications

95% of users rated our process easier than the competition.

From AI-powered tech for tax invoices to a digital portal for tracking applications we’re always innovating to make finance faster and easier.

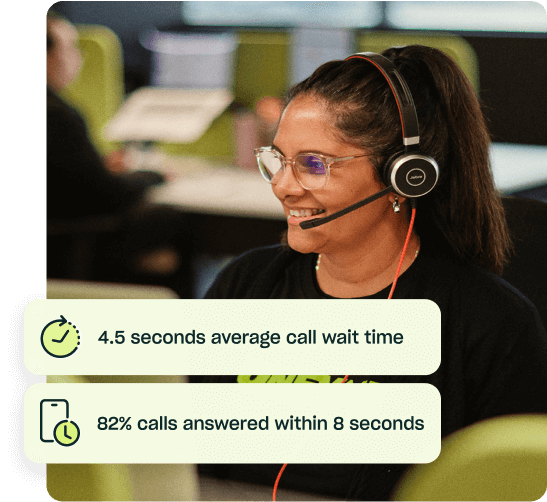

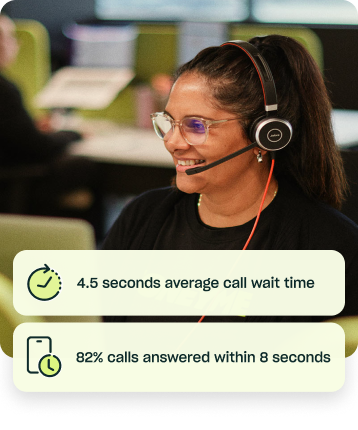

No waiting on call backs

We have flipped the traditional BDM model and have a dedicated support team always on stand by who can answer calls in seconds.

Get expert advice, status updates and more, 7 days a week.

Ready to offer your clients market-

leading car finance?

Award-winning lender

*Only available for eligible vehicle and applicants