About MONEYME

Click on a category to see options

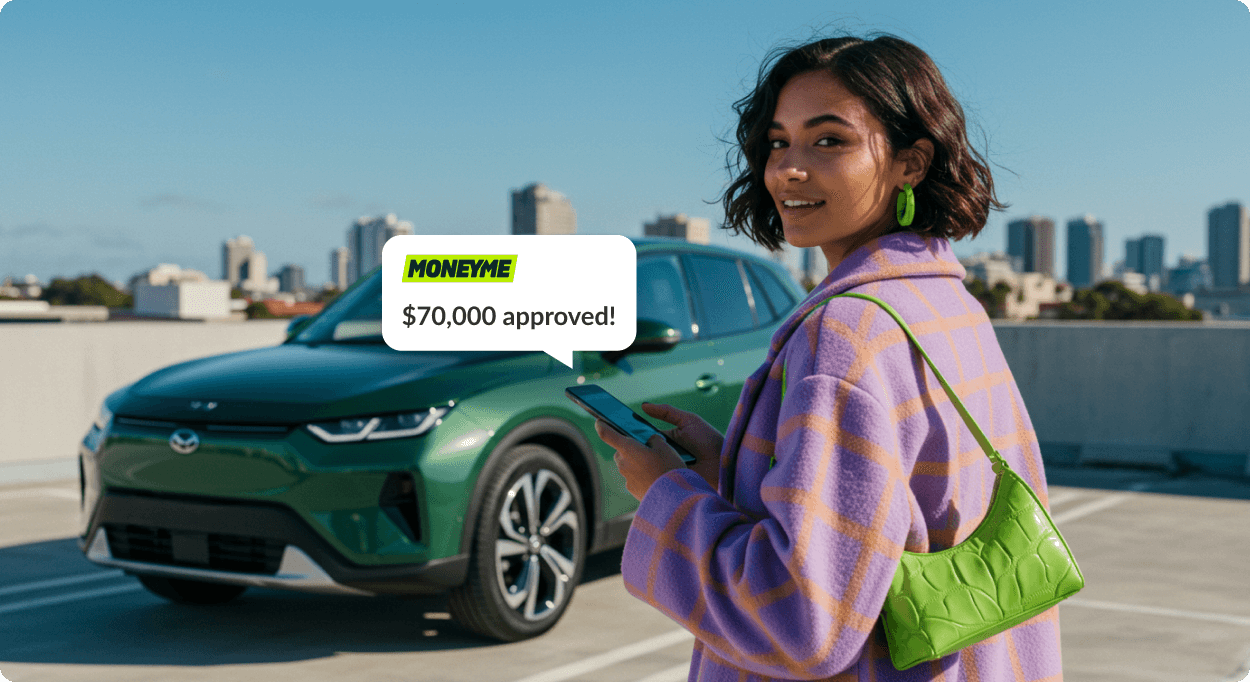

Unsecured car loans up to $70,000

See it. Buy it. Drive it.

Drive away same-day with our bank-beating rates, speed & service.

p.a.

p.a.

Takes minutes with no impact to credit score

- Showing results for

Car Repair Financing

Simple terms.

No hidden fees.Simple terms. No hidden fees.

With no impact to your credit score

Start with an obligation-free quote

There's no paperwork required and no impact to your credit score. Get all the important information you need before you apply.

Personalised rate

Check your rate and repayments before you apply

Borrowing power

Calculate the maximum amount you can borrow

Eligibility check

Confirm you are eligible before you apply

Same day loans

If you proceed with your quote, we offer funding in as little as 60 minutes

With no impact to your credit score

Low rates that

beat the banks

Get a better a deal with our bank-beating rates.

MONEYME

CommBank

ANZ

NAB

Westpac

Click here for important information on comparison rates. All rates are for variable rate loans, unless noted with an asterisk (*), which indicates a fixed rate loan. Comparison excludes short-term promotional rates. Last updated 02/02/2026.

Ready to get a quote?

Find out your rate and repayments in under 90 seconds

With no impact to your credit score

How our car loans work

Step 1

Start with a quote

No credit score impactGet a quote to find out how much you could borrow (up to $70,000) and your personalised rate. You can also view repayment options to help you budget.

Step 2

Get conditional approval

No credit score impactGet conditional approval by providing a few more details, like your income and expenses. No need to use the vehicle as security with our unsecured loan.

Step 3

Same-day funding

Accept your offer and we'll complete one final review. If everything looks good you could drive-away that day with funds in your account in as little as 60 minutes (even on weekends).

About MONEYME's loan for car repairs

When your car breaks down, you can find your life grinds to a halt; get your car back on the road as soon as possible with a car repair loan from MONEYME. Unlike some lenders, we do not require invoices; you merely let us know how much money you need and apply for the amount.

Our online application and approval process could see you receiving the funds on the same day as you request them, giving you back control and minimising disruption to your life. With no early repayment fees, we help you to keep your finances on track.

Award-winning lender

Trusted by over 110,000 Aussies

MONEYME Reviews Average rating: 4.7, based on 4700 reviewsWith no impact to your credit score

How to apply for a car repair financing loan

Applying for a personal loan to repair your car is so simple with MONEYME’s streamlined process:

- Get your online quote in 90 seconds to see your rate and repayments without impacting your credit score.

- If your happy with your rate and repayment figure you can finish your online application with just a few extra details.

- If approved, you could receive the funds on the same day and get your car out of the repair shop pronto!

Purpose-driven

and responsible

At MONEYME, we're not just here to provide low rate loans - we're here to make a difference. We believe in providing smart, responsible lending that keeps you financially on track, whilst doing good for the planet.

As a Certified B CorporationTM we're big on sustainability. We hold ourselves accountable to the high standards of the B Corp movement, supporting renewable energy projects, doing our part for the community, and striving towards a greener future.

Explore our impact

*This comparison rate is based on an unsecured variable rate personal loan of $30,000 for a term of 5 years. Rates displayed are for customers with an excellent credit history, where a $0 establishment fee applies. For other borrowers, an establishment fee of $395 or $495 will apply, based on loan amount. A $10 monthly fee applies to all personal loans. WARNING: This comparison rate is true only for the example given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate.