Complete in minutes

Credit Card Fast Approval

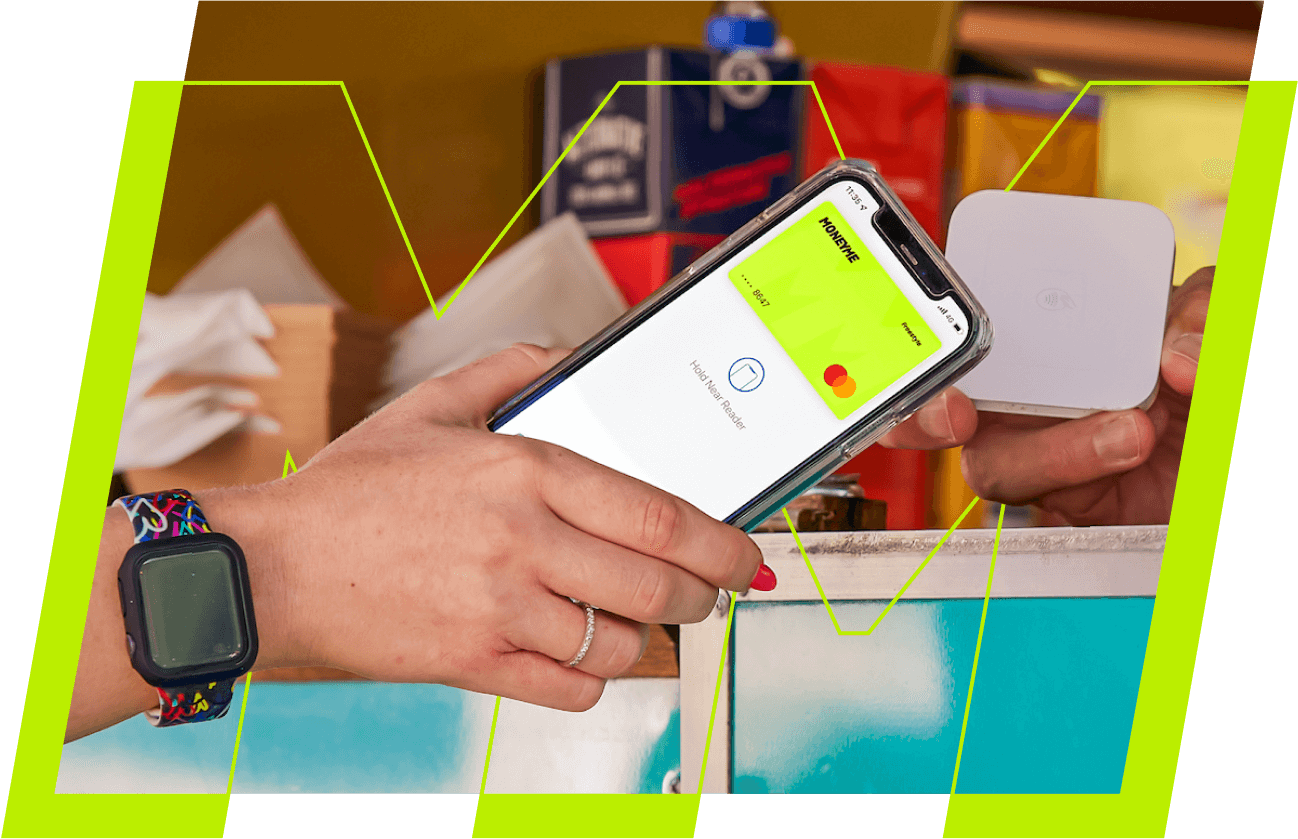

Use your card instantly once approved.

An award-winning experience

FAQs about Freestyle Credit Card

How do credit cards work?

A credit card lets you borrow money from a bank or other lenders and use it for transactions and purchases without paying in cash. Also known as a revolving line of credit, with a credit card you are given a specific amount of funds or a credit limit that you can use anytime.

Just like how it is with loans or debts, you also have repayments in credit cards. The fees and charges will depend on which type of credit card you are applying for.

What are the different types of credit cards?

Different types of credit cards are designed for different financial needs, spending habits and repayment preferences. Find out which type suits you:

- Low Rate. Low rate credit cards are designed for consumers who want flexible repayment options. This type of credit card is ideal for people who would like to have fast access to cash for everyday spending or those who make big purchases regularly. The interest rate is low, which makes it easier for you to pay off the balance over time.

- Rewards. This type of credit card gives you a corresponding point for every dollar you spend. Some credit cards may give you special points for a certain purchase, such as extra points for using your card on affiliate stores, hotels or airfares. A rewards credit card is suitable for consumers who are looking to get returns such as cashback or vouchers.

- Travel. Also termed as “frequent flyer”, this type of credit card allows the cardholder to redeem points for international or domestic flights for every dollar spent. You can then use the air miles or points you earned for perks such as free travel, gift cards or receive elite status on hotels or any travel-related expenditures.

Where can I use a credit card?

As there are different types of credit cards, consumers apply for a credit card for various reasons as well. For starters, people may get a credit card because they prefer the safety of cashless payments over carrying a huge amount of hard cash for transactions. It also allows consumers to delay a large payment and settle it into smaller repayments.

If your credit card is new, you may be given an initial bonus for spending a certain amount and use the cashback for future purchases. Some other common uses of credit cards are to earn rewards points and frequent-flyer miles.

Can anyone get a line of credit?

Applying for a line of credit requires similar qualifications as when you apply for a personal loan or a credit card. You must be a resident of Australia, currently working and at least 18 years old to be eligible to apply.

Take note that your creditworthiness – which is determined by your income, credit history and overall financial health – will also be taken into account by your prospective lender during the assessment of your application.

Which is better, a line of credit or a personal loan?

With a line of credit you can borrow up to your maximum credit limit, with funds readily available for you to use again once you have repaid them. Your monthly payment amount on a line of credit relies on your interest rate, outstanding balance and the agreed terms. As for a personal loan, it gives you a lump sum which makes monthly repayments easier to budget. So the real answer strongly depends on what credit solution better fits your need and financial situation at the time you wanted to apply for one.

What is a secured line of credit?

Secured lines of credit are backed by collateral – which means you need to secure your line of credit against your personal assets, such as your home equity, car or some other valuable property. The lender has the right to seize the asset in the event you fail to repay your line of credit.

What is an unsecured line of credit?

An unsecured line of credit is not backed by any asset. Since there is no collateral involved, it usually comes with higher interest rates to pose lesser risks to the lender.

Am I eligible to apply for a credit card?

In order to apply for a Freestyle Virtual Mastercard, you will need to be at least 18 years old, an Australian citizen or a resident, and have a regular source of income.

Can I get a credit card with a poor credit score?

Here at MONEYME, we see the whole picture when a customer applies for a credit card. Your credit score may be one of the most important factors, but we also consider your income, financial commitments and general living expenses to come up with a fair decision.

How do I apply for a credit card?

You can apply for a credit card online, over the phone or by visiting the physical branch of your prospective lender. As our process is entirely online with no face-to-face interactions, if you would like to apply for a Freestyle card you may click here—the application process is streamlined and only takes a few minutes. You may also apply via the MONEYME app available on App Store and Google Play.

How can I manage my credit card account?

You can manage your Freestyle account via the Member’s Area or by simply logging in to the MONEYME app. With 24/7 access to your account, you may view your transaction history, manage your credit limit, check your account status, and more.

Can I pay anyone using my card?

Yes. Apart from transferring funds to your personal bank account, Freestyle comes with a pay anyone feature that lets you send money straight to your friend’s or anyone’s account.

What is a credit limit?

Your credit limit is the maximum amount of credit approved by your card provider when you apply for a new card. This is the total amount of money you can borrow on your credit account. Credit limits are not similar for everyone, and the amount you may get approved for depends on the maximum amount the card company can lend and your personal circumstances.

How much can I borrow for a line of credit?

Your credit limit, or the maximum amount of money you can borrow for a line of credit, is tailored based on your individual circumstances and application. Here at MONEYME, our credit limits range from $1,000 to $20,000. To determine your personal credit limit, we consider a range of factors such as your credit history, income, debt obligations and living expenses.

How do I increase my line of credit limit?

You may be putting almost all of your everyday spending on your credit card. Times are also changing and you need more emergency money, or you may be after certain rewards that you cannot hit with the current maximum amount you are allowed to spend. In this case, you might want to take your chance to get a bigger credit limit.

To increase your credit limit, you have to contact your credit card provider. You may either call a specific number or send a request online. Here at MONEYME, you may apply for a credit limit increase by logging in to your MONEYME account. Simply adjust the set credit limit according to your desired new credit limit, click submit and wait for the outcome of your request. Take note that your request is subject to further evaluation, and the outcome will depend on your financial standing and payment history with us.

What are the fees and charges for a line of credit?

The common fees associated with a line of credit are annual fee, monthly fee and interest rate. You don’t need to pay any interest unless you have used your money. We base the annual fee on your credit limit, and the monthly fee is waived if your balance is less than a specific amount.

Dishonour fee of $15

This is payable each time a direct debit is dishonoured on your commitment to make a loan repayment is not met.

Overdue account fee of $35

Payable when the repayment is 7 days overdue, and again every 14 days thereafter, until arrears are cleared or a cap of $210 is reached.

Why should I use a line of credit?

People use a line of credit for a variety of reasons. Apart from giving you the freedom to decide on what to purchase or what to use it for, a line of credit allows you to apply for a maximum credit limit and only make repayments based on the amounts you have used. It is flexible and convenient, allowing you to reuse the funds that you have successfully repaid.

Where can I get a line of credit?

There are many ways you can get a line of credit, such as applying through banks, credit unions or online lenders. In banks, a line of credit may be granted to both new and existing customers. They provide you with a pre-approved limit without having the need to re-apply. The response time is usually 1 up to 15 working days, depending on which bank you’re applying to. Online lenders offer pre-approved credit limits as well, with a much faster response time. Each credit provider has unique offers and maximum credit limit available, so it is best to make a research before applying for one.

What is the difference between a line of credit and a credit card?

There are plenty of similarities between a line of credit and a credit card, but the primary difference is that a line of credit approves you a certain credit limit that you can borrow against a revolving credit line. You can borrow as much or as little as you like, and that you can reuse the funds you have successfully repaid. As for a credit card, it allows you to make purchases that you can pay back in instalments.

A line of credit typically has a higher credit limit and can be either secured or unsecured. On the other hand, a credit card is almost always unsecured.

Our customers

LOVE us

Credit Card Fast Approval

Jayceenemo

Aug 09, 2023

Aug 09, 2023

Fast, fair and easy. Very happy customer. Happy to get another loan in the future from MONEYME.

BGC

Jun 13, 2023

Jun 13, 2023

Simple process, easy to follow application, quick response time and good support.

Brad

May 31, 2023

May 31, 2023

I was impressed with how easy and quick the application was. Very happy with their customer service, and the app is very convenient.

4.6/5

Out of 2,701 reviews