How do credit cards work?

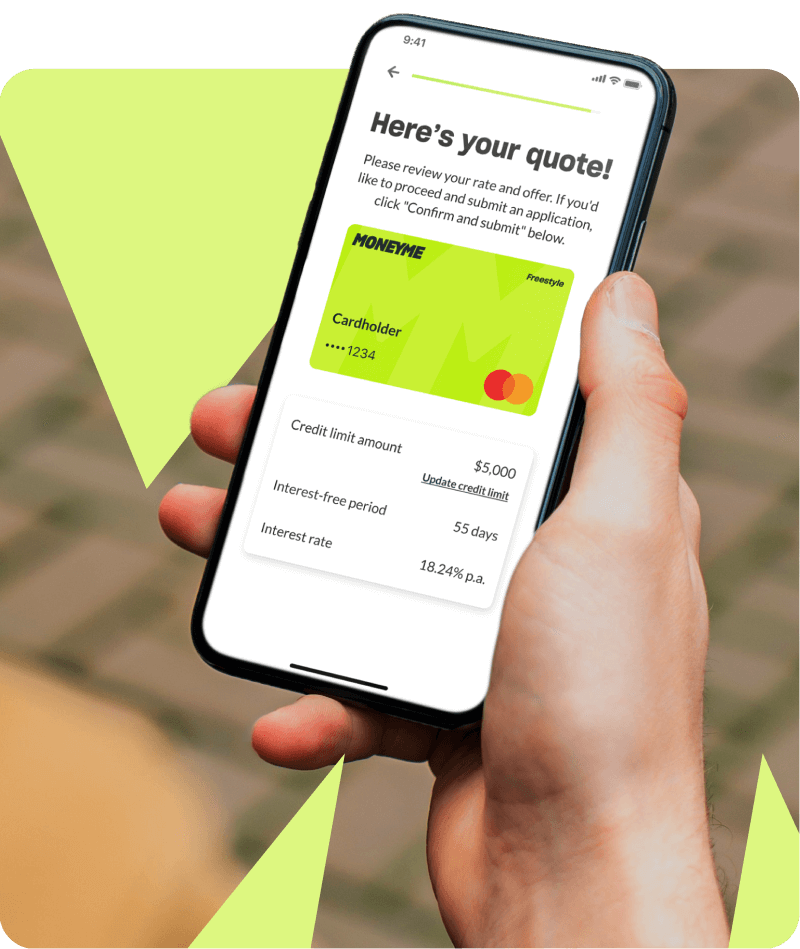

A credit card lets you borrow money from a bank or other lenders and use it for transactions and purchases without paying in cash. Also known as a revolving line of credit, with a credit card you are given a specific amount of funds or a credit limit that you can use anytime.

Just like how it is with loans or debts, you also have repayments in credit cards. The fees and charges will depend on which type of credit card you are applying for.

What are the different types of credit cards?

Different types of credit cards are designed for different financial needs, spending habits and repayment preferences. Find out which type suits you:

- Low Rate. Low rate credit cards are designed for consumers who want flexible repayment options. This type of credit card is ideal for people who would like to have fast access to cash for everyday spending or those who make big purchases regularly. The interest rate is low, which makes it easier for you to pay off the balance over time.

- Rewards. This type of credit card gives you a corresponding point for every dollar you spend. Some credit cards may give you special points for a certain purchase, such as extra points for using your card on affiliate stores, hotels or airfares. A rewards credit card is suitable for consumers who are looking to get returns such as cashback or vouchers.

- Travel. Also termed as “frequent flyer”, this type of credit card allows the cardholder to redeem points for international or domestic flights for every dollar spent. You can then use the air miles or points you earned for perks such as free travel, gift cards or receive elite status on hotels or any travel-related expenditures.

Where can I use a credit card?

As there are different types of credit cards, consumers apply for a credit card for various reasons as well. For starters, people may get a credit card because they prefer the safety of cashless payments over carrying a huge amount of hard cash for transactions. It also allows consumers to delay a large payment and settle it into smaller repayments.

If your credit card is new, you may be given an initial bonus for spending a certain amount and use the cashback for future purchases. Some other common uses of credit cards are to earn rewards points and frequent-flyer miles.

Can anyone get a line of credit?

Applying for a line of credit requires similar qualifications as when you apply for a personal loan or a credit card. You must be a resident of Australia, currently working and at least 18 years old to be eligible to apply.

Take note that your creditworthiness – which is determined by your income, credit history and overall financial health – will also be taken into account by your prospective lender during the assessment of your application.

Which is better, a line of credit or a personal loan?

With a line of credit you can borrow up to your maximum credit limit, with funds readily available for you to use again once you have repaid them. Your monthly payment amount on a line of credit relies on your interest rate, outstanding balance and the agreed terms. As for a personal loan, it gives you a lump sum which makes monthly repayments easier to budget. So the real answer strongly depends on what credit solution better fits your need and financial situation at the time you wanted to apply for one.

What is a secured line of credit?

Secured lines of credit are backed by collateral – which means you need to secure your line of credit against your personal assets, such as your home equity, car or some other valuable property. The lender has the right to seize the asset in the event you fail to repay your line of credit.

What is an unsecured line of credit?

An unsecured line of credit is not backed by any asset. Since there is no collateral involved, it usually comes with higher interest rates to pose lesser risks to the lender.