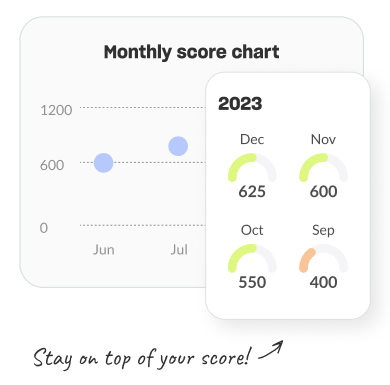

Understand how

lenders see you

When applying for loans and credit, your credit

score can affect your approval chances and the

interest rate you’re offered.