About MONEYME

Award-winning lender

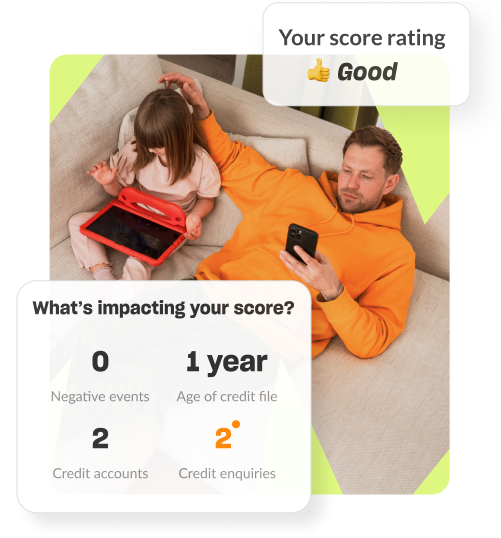

Get in-depth insights

See what's on your credit file, how it's impacting your score and what you can do about it.

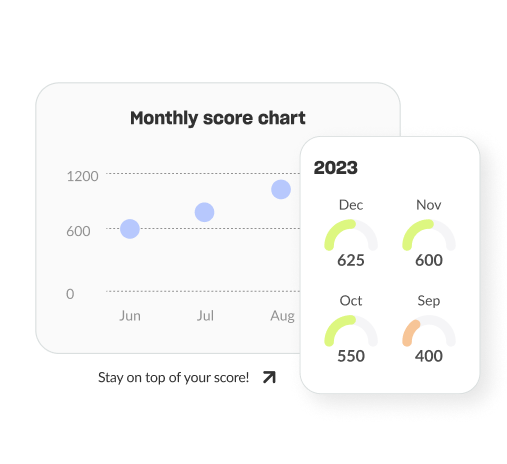

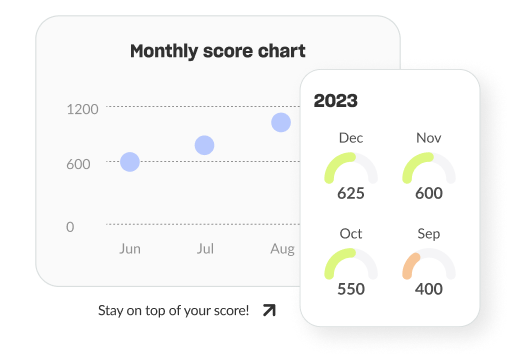

Track your progress

We keep track of your score history so you can see how your score changes over time. Watch it improve or spot when something has impacted it negatively.

Boost your knowledge

Learn all there is to know about credit scores. We share useful tips and tricks on how to boost your score, how to avoid the common mistakes that will tank it, and much more.

Free Credit Score Check Australia

You’re probably wondering about the state of your credit profile, which has led you to look up ‘free credit score check Australia’. Certain transition points in life, like moving to a new apartment, getting a new credit card, buying your first car, or purchasing your first home, require financial institutions to look into your creditworthiness or your reliability as a borrower.

How do lenders achieve this, though? They do this by looking at your credit score. Your credit score ranges from 0 to 1,000 or 0 to 1,200, depending on the credit reporting agency, and this seemingly innocuous figure actually sheds a lot of light on your financial health. If you’re typing in ‘free credit score check Australia’, it’s probably because you know just how important a good credit score is in the world of personal finance.

There are several reasons you might be looking into your Australian credit score. If you’ve recently graduated college and are looking to move out of the suburbs into a more job-dense metropolitan area, the first item on your checklist is probably to find a new apartment.

But future renters should know that landlords and property managers often make it a habit to review credit scores as part of the screening process. After all, a good credit score demonstrates a potential tenant’s ability to pay rent consistently and on time.

Another reason you could be scouring search results for ‘free credit score check Australia’ is the need for a new car. So you’d like to upgrade your car but don’t necessarily have the liquidity to pay for it in full. This is where bank or in-house financing would come in handy, but in these cases, hard credit checks are typically conducted. You’ll want to ensure your credit score is in tip-top shape to maximise your chances of approval since it is a measure of creditworthiness.

And it isn’t just improved loan approval chances that make checking your credit scores important. Those with a higher credit score often enjoy lower interest rates and more favourable payment terms, which decreases financial pressure in the long run.

Here at MONEYME, we want to help you get to the bottom of your credit score enquiry so you can get a full picture of your financial situation.

Where can I request a free credit score check in Australia?

If you’re looking up ‘free credit score check Australia’ because you don’t want to shell out cash to see your credit report, we have good news for you. Major credit reporting bodies like illion, Equifax, and Experian allow you to request a free credit score check.

These companies have stored financial data about you, such as your personal information and your borrowing history with various lenders. With this data, they’re able to generate a credit report and calculate your credit score.

Here’s the bad news for those searching up ‘free credit score check Australia’, though. The credit reporting bodies only allow you to see your credit score for free once every three months. In certain situations, this can be inconvenient.

Let’s say you’ve had a financial history that has resulted in a less-than-perfect credit record. You could be figuring out how to improve your credit score. To track your progress, the ability to see credit score improvements over time – and with just a few taps – is incredibly crucial.

Now the question on your mind could be, ‘Where can I find my credit score?’ Good news again. What if we told you there’s an even simpler solution for those typing in ‘free credit score check Australia’?

How many times can I request a credit rating check?

With MONEYME's Credit Score tool in the MONEYME mobile app, you can now get a free, fast, and personalised credit score. The very same information that banks and lenders use to determine creditworthiness will now be available to you. Additionally, we'll give you tips and tricks on how to improve your credit score, along with special offers.

If your search history’s filled with terms like ‘free credit score check Australia’, you’ll be delighted to know that with the MONEYME Credit Score tool, not only can you get a free credit score check in a matter of minutes, but you’ll also be able to track its improvement over time.

With our monthly score chart, we can keep track of your score history, so you can easily see how your score changes over time. Watch the graph rise when you continue good borrowing habits, and enable yourself to course-correct as soon as possible once something impacts your score negatively.

What does a credit report contain?

An individual's credit report contains information about their financial history and credit history. The data is compiled by credit bureaus using information provided by lenders, creditors, and other third parties.

Depending on which credit bureau you enquire with, your credit report usually contains the following information:

- Your past borrowing history

- Repayment history for any credit cards or loans you have

- Credit limits, for example, on a credit card

- How often and how many applications you have made in the past

- If you have any bankruptcies, defaults, or court judgements against you

Luckily, those whose credit scores need improvement can rest assured that positive financial habits can raise their score. Making consistent and timely repayments will give lenders a clearer picture of you as a borrower. If they can see that your ability to pay has improved now compared to the past, then they have the information they need to dole out a fair decision.

The MONEYME Credit Score tool makes it simple to find out your score. Let us know a few basic details about you, including your name, number, email address, date of birth, address, and optionally, your driver's licence number, and we will handle the rest.

Keep a close eye on your credit score and bring yourself one step closer to financial health. Now, you can get your credit scores for free with the MONEYME Credit Score tool.

What our customers say

With no impact to your credit score

A different kind of lender

Quick quotes,

fast approvals

We cut out unnecessary paperwork and delays with lending that's fast, simple, and built around you.

Transparent and flexible

No lock in contracts, hidden fees or surprises - just flexible options that keep you in control.

Real support, real fast

Speak to a real person if you have questions, we usually answer calls in seconds.

For people and the planet

We care about our social and environmental impact, and we're proudly B Corp Certified.

With no impact to your credit score

Purpose-driven

and responsible

At MONEYME, we're not just here to provide low rate loans - we're here to make a difference. We believe in providing smart, responsible lending that keeps you financially on track, whilst doing good for the planet.

As a Certified B CorporationTM we're big on sustainability. We hold ourselves accountable to the high standards of the B Corp movement, supporting renewable energy projects, doing our part for the community, and striving towards a greener future.

Explore our impact

*This comparison rate is based on an unsecured variable rate personal loan of $30,000 for a term of 5 years. Rates displayed are for customers with an excellent credit history, where a $0 establishment fee applies. For other borrowers, an establishment fee of $395 or $495 will apply, based on loan amount. A $10 monthly fee applies to all personal loans. WARNING: This comparison rate is true only for the example given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate.