Some banks and financial institutions may provide free Australian credit score checks for customers. They access credit reports and scores from major credit reporting bodies like illion, Equifax, and Experian.

The credit reporting agencies collect and store financial data to create credit reports and calculate credit scores. Lenders rely on these scores as one way to evaluate the potential risk involved in providing credit to borrowers.

If you’ve been constantly wondering, ‘How do I check credit score in Australia?’ or ‘How do I check my credit score for free?’ there’s an even simpler way to access your credit information with MONEYME’s easy-to-use Credit Score tool.

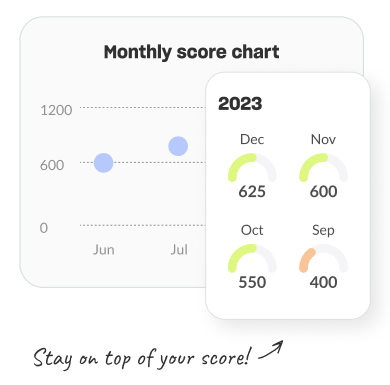

A powerful feature that is seamlessly integrated into our mobile application, this tool streamlines and simplifies the often convoluted process of obtaining your credit score. It’s all about accessibility, efficiency, and personalisation.

Available for download on both the Apple Store and Google Play, the MONEYME app is an all-in-one tool designed with the user in mind. After downloading the app, all you need to do is provide a few basic details. Within minutes, you have a fast and free way to check your credit score. It’s that easy!

But the functionality of the MONEYME Credit Score tool extends far beyond just providing a credit score. It offers comprehensive access to the same information that banks and financial lenders use to assess your creditworthiness. Armed with this invaluable insight that allows you to no longer look up ‘how to check credit score in Australia’ online, you gain a bird’s eye view of your financial standing.

What’s more, the tool also generates specific suggestions to boost your credit score and provides you with exclusive offers that are tailored to match your unique financial profile.

With our secure process, the MONEYME Credit Score tool offers an unprecedented way to obtain a credit rating check. Gone are the days when you had to navigate through intricate procedures, fill out extensive forms, and decipher complicated jargon. All the information you need is just a few taps away on your phone, courtesy of the MONEYME app.

This tool adds a layer of convenience that drastically enhances the user experience. The ease and speed at which you can access your credit details are simply unparalleled. It’s a smart, intuitive, and efficient tool designed to simplify credit score checks while providing meaningful financial insight.

So, whether you’re looking to apply for credit or simply want to keep track of your financial health, the MONEYME Credit Score tool is your go-to solution.