Understanding how to work on credit score issues is a huge aspect of maintaining one’s financial health. Credit scores are numerical assessments of your creditworthiness, determined by major credit reporting bodies like illion, Equifax, and Experian.

These credit reporting bodies collect a wealth of financial data about you, generating what we commonly refer to as a credit report. This report and the associated credit score are tools lenders use to determine your potential risk as a borrower.

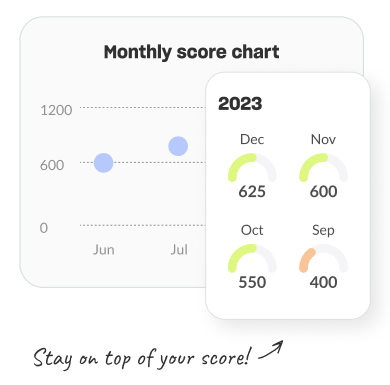

While it’s possible to request a free credit report from each of these reporting bodies once every three months, we at MONEYME offer you a more streamlined solution. With our free Credit Score tool, available via the MONEYME mobile app, you can quickly and conveniently check your credit status at any time and learn how to work on credit score issues as needed.

Our tool not only provides the answer to how to check your credit score for free, but it also gives you insights into your credit report equivalent to what banks and other lenders see.

The MONEYME Credit Score tool goes beyond just providing a number. It equips you with tips and strategies on how to work on credit score inadequacies or mistakes in order to improve them, plus it gives you access to special offers that can enhance your financial journey. All of this valuable information is just a few taps away.

Getting your credit score has never been simpler or more accessible. By downloading the MONEYME app from the Apple or Google store, you can get your credit score in minutes. The only information you need to provide is your name, number, email, DOB, address, and optionally, your driver’s licence number.

Take control of your financial health today and get your credit scores checked as soon as possible. It’s easy, free, and could significantly impact your future financial opportunities.