If you are at least 18 years old, a permanent resident in Australia, and currently generating income from work, you can apply for our small car loans.

To begin, head over to our application page and enter your personal details, including name, email address, employment status, and bank account information.

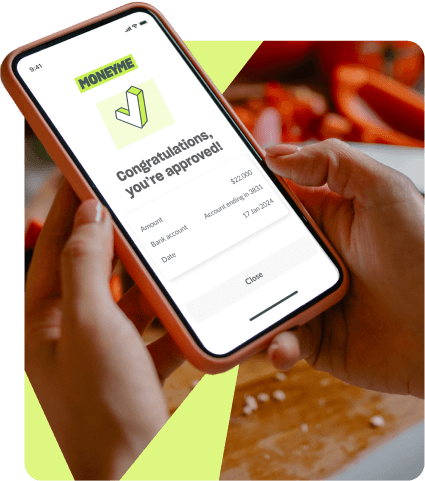

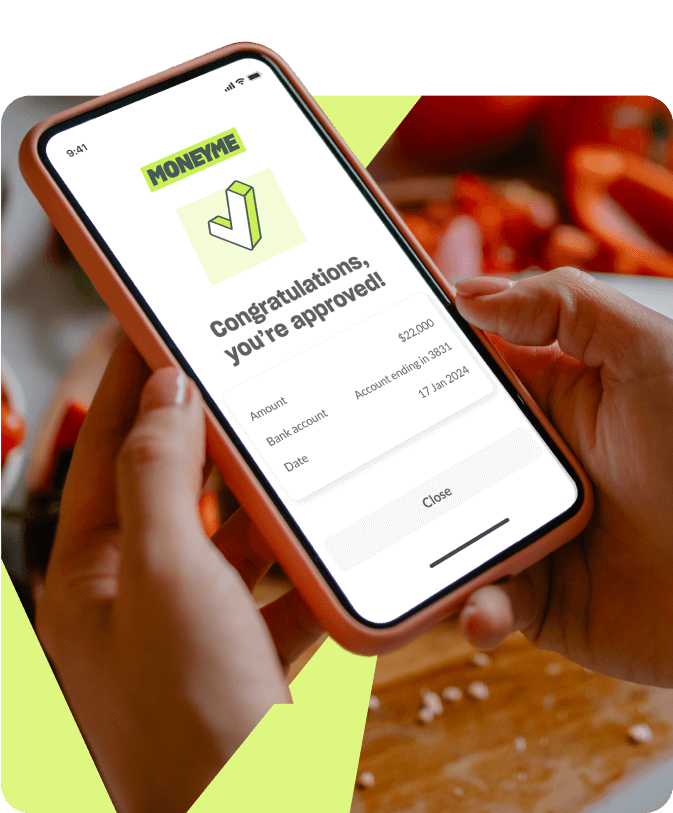

Once you submit your application, a member of our team will review it and get back to you through our online portal in as little as 60 minutes with a decision on your approval. If approved, we can typically transfer the funds into your bank account the same day.

That’s basically all the information you need when applying for our online car financing. At MONEYME, we understand that when you need cash urgently, you may not have time to go through the usual application process or fill out complicated paperwork. That is why we offer fast and easy vehicle loans that you can apply for online in just a few minutes.

If you want an estimated quote for our auto loans, just navigate through our platform and utilise our intuitive car payments calculator.

Become a part of the MONEYME family today and experience a service built by Generation Now, for Generation Now!