The popularity of terms like ‘credit score check Australia’ and ‘free credit score Australia’ are on the rise these days.

It’s no surprise since checking your credit rating is a good way to get your finances in order. It’s especially helpful if you need extra funds, as more and more people are leveraging loans, credit cards, cash advances, and other similar offerings to cover their dream purchases, start businesses, and invest in their future.

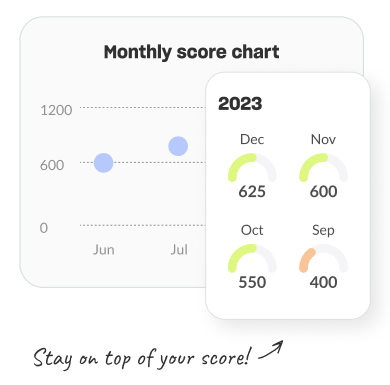

The great news is that a credit rating check doesn’t have to be complicated. MONEYME is here to help ease those feelings of frustration through our innovative Credit Score tool. With us, you can count on a credit report check that’s not only 100% free but simple as well.

There’ll be no more looking up topics like ‘credit score check Australia’ online or asking yourself ‘How do I check my credit score?’ for hours on end. All you have to do is use our MONEYME mobile app, which you can download from either the App Store or Google Play Store.

It’s incredibly easy to use; just start by entering your contact details. This would include your name, number, email, DOB, address, and driver’s licence number (optional). With all the data you’ve provided, we’ll run an individualised credit check so you can take note of the same information banks and lenders see when they gauge your creditworthiness.

Aside from free credit scores, we can also give you tips and tricks that’ll help you build your personal rating and even present you with special offers. As such, you’ll know more about your unique financial situation and learn about how you could improve your chances of a successful credit application.

To give you a better idea, you’ll receive a comprehensive summary of the following points when you try out our MONEYME mobile app.

- How much credit you’ve previously borrowed

- Your repayment history (for loans, credit cards, etc.)

- Current credit limits you’re following, e.g., on a credit card

- The applications you’ve submitted before and how often you made them

- Court judgements, defaults, or bankruptcies in your name

With this information at hand, you can begin facing your finances and managing them to your liking. Now that you know how to check your credit score with MONEYME, you can conclude your search for terms like ‘credit score check Australia’ and ‘credit check Australia’.