If you’ve ever asked questions like, ‘What is a credit score? What is good credit?’ you might have thought that understanding your credit score was a complex task. It can feel like you’re trying to decode a secret language full of financial jargon and mysterious algorithms. But here’s the silver lining – it’s not as complicated as it seems!

In Australia, three main credit reporting bodies, namely illion, Equifax, and Experian, are responsible for gathering and maintaining your financial information. By analysing this data, they create your credit report and determine your credit score. Subsequently, lenders rely on this score to evaluate your borrowing risk.

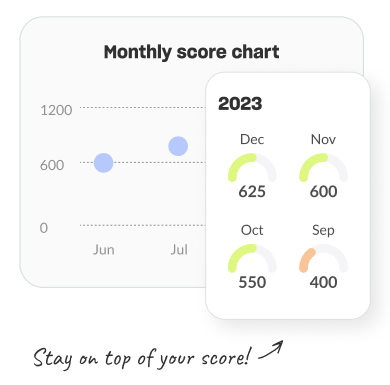

You can request your credit scores for free once every three months from each credit reporting body. Although nowadays, there’s an even simpler way to stay informed if you’ve been asking, ‘What’s my credit score?’

At MONEYME, we offer an easy-to-use Credit Score tool that provides a free, fast, and personalised credit check through the mobile app. You can see the same information that banks and lenders use to evaluate your creditworthiness, and you’ll also get access to tips and tricks on how to work on credit score ratings as well as special offers.

When it comes to personal finance, people often wonder, ‘What is my credit score? What is good for loans?’ since it’s a key factor for lenders. So, if you’re one of the many people looking to get their credit score quickly so they can determine whether theirs is good or not, just download the MONEYME app from the Apple or Google app stores. Fill in some basic details, and you’ll be able to see your score in just a few minutes.