On the topic of ‘how to get credit scores’ and ‘how to improve credit score Australia’, you can access your credit history one of two ways: through your credit reporting agency, as mentioned above, or through online services like the MONEYME app.

As an Australian citizen, you are entitled to your credit history report. You can request free credit scores from your credit reporting agencies once every three months. You can also request another free copy of your credit report if you’ve been refused credit within the past ninety days or if you’ve reported and asked for corrections on errors in your credit history. Beyond these instances, you may be asked to pay a small fee before they send you a copy of your credit report.

The great news is that there’s an easier and more convenient way to review your credit score: the MONEYME app.

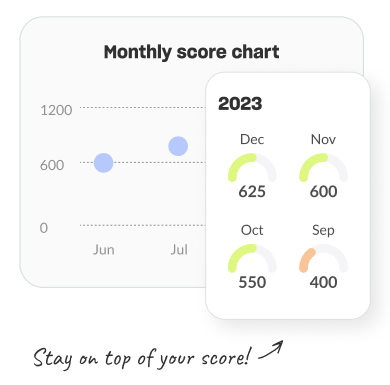

MONEYME’s Credit Score tool – accessible through the MONEYME mobile app – gives you access to a free and quick credit check personalised just for you. Our Credit Score tool shows you the same information available to banks and lenders when they evaluate your creditworthiness. Through the app, you’ll also receive helpful tips to help you boost your score and establish a healthier financial profile. You’ll even gain access to special offers depending on your eligibility for such offers.

The MONEYME app is available through the Apple App Store and Google Play Store. Once you’ve downloaded the app, simply create a user account by entering a few personal details, such as your name, mobile number, email address, and other requested information.

A good credit score is a long-term commitment that can have a big impact on your finances and personal opportunities. This is why building and maintaining your credit score should be taken seriously, and researching topics like ‘how to improve credit score Australia’ is the first step forwards.

By looking out for your credit score today using the MONEYME app, you’re also investing in your goals for tomorrow.