About MONEYME

Click on a category to see options

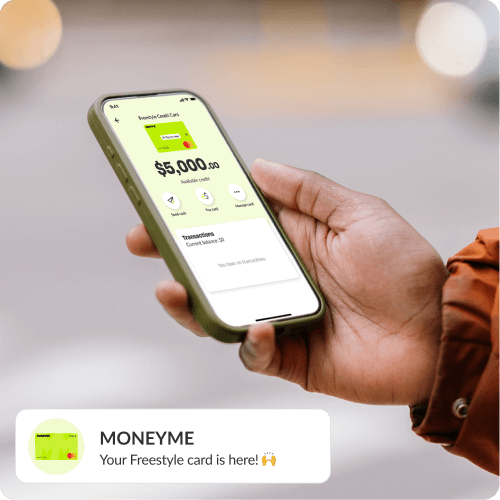

Freestyle Credit Card

100% digital. Available in minutes, not days.

A credit card designed for today with up to 55 days interest-free1 and zero-fee options.

- Showing results for

Line of Credit

A digital credit card for everyday

Up to 55 days interest free

Get up to 55 days interest-free on credit card purchases

Tap, shop and transfer

Tap & pay in-store, shop online or transfer to any bank account

Ready to use in minutes, not days

Your credit card can be approved and ready to use in minutes

100% digital, zero plastic waste

All the things you need from a credit card, without the plastic

Interest free days and zero fee options

Enjoy more flexibility with up to 55 days interest free on everyday purchases.

Interest free days and zero fee options

Enjoy more flexibility with up to 55 days interest free on everyday purchases.

Get a credit card in just a few steps

Get your credit card offer and check your credit limit and interest rate before you apply. It takes just a few minutes and won't impact your credit score.

Apply in minutes

Apply for a Freestyle Credit Card online or via the

MONEYME app. Keep your driver's licence ready

to verify your account.

Choose a credit limit

Get your credit offer and choose a credit limit from

$1,000-$10,000 to suit your needs.

Add to your mobile wallet

Activate your Freestyle Credit Card to start spending

immediately, once approved.

A different kind of lender

Quick quotes, fast approvals

We cut out unnecessary paperwork and delays with lending that's fast, simple, and built around you.

Transparent and flexible

No lock in contracts, hidden fees or surprises - just flexible options that keep you in control.

Real support, real fast

Speak to a real person if you have questions, we usually answer calls in seconds.

For people and the planet

We care about our social and environmental impact, and we're proudly B Corp Certified.

Line of credit loan provider

Apply for a fast and simple line of credit with MONEYME for greater financial flexibility. As a leading digital lender, our systems are built around your needs. Access quick quotes and same-day approvals when you take out a personal line of credit with MONEYME.

We’re a proud B Corp certified company with over 450,000 happy Australian customers, so you’ll be in great company! Check out our 3,500 5-star reviews and simply download our app to make an application. Prefer to chat? Simply call, and our friendly team will answer you within seconds.

Award-winning lender

Trusted by over 110,000 Aussies

MONEYME Reviews Average rating: 4.7, based on 4700 reviewsGet a line of credit with our Freestyle Credit Card

It couldn’t be easier to get a quick and simple line or credit with MONEYME. Simply:

Complete the short application form, providing digital ID verification. Wait for our soft credit check and application review, and check our clear and transparent terms to ensure you’re happy with them. Once approved, we’ll immediately send you your digital Freestyle credit card, which can be used as soon as you receive it. Simply save it in your mobile wallet. For any queries, our friendly team is here to help and will answer your call in seconds.

Purpose-driven

and responsible

At MONEYME, we're not just here to provide low rate loans - we're here to make a difference. We believe in providing smart, responsible lending that keeps you financially on track, whilst doing good for the planet.

As a Certified B CorporationTM we're big on sustainability. We hold ourselves accountable to the high standards of the B Corp movement, supporting renewable energy projects, doing our part for the community, and striving towards a greener future.

Explore our impact

1Conditions apply to the interest free period. Refer to the Terms and Conditions for the Account for further information. After the interest free period, an interest rate of 18.74% p.a. to 23.74% p.a. will apply.

2The actual rate that you receive will depend on a range of factors, including your credit score.

3Applications and maximum credit limits are subject to eligibility criteria including credit approval. Other terms and conditions may apply.