Dreaming of a bathroom remodel and wondering whether you can afford bathroom renovation costs Sydney?

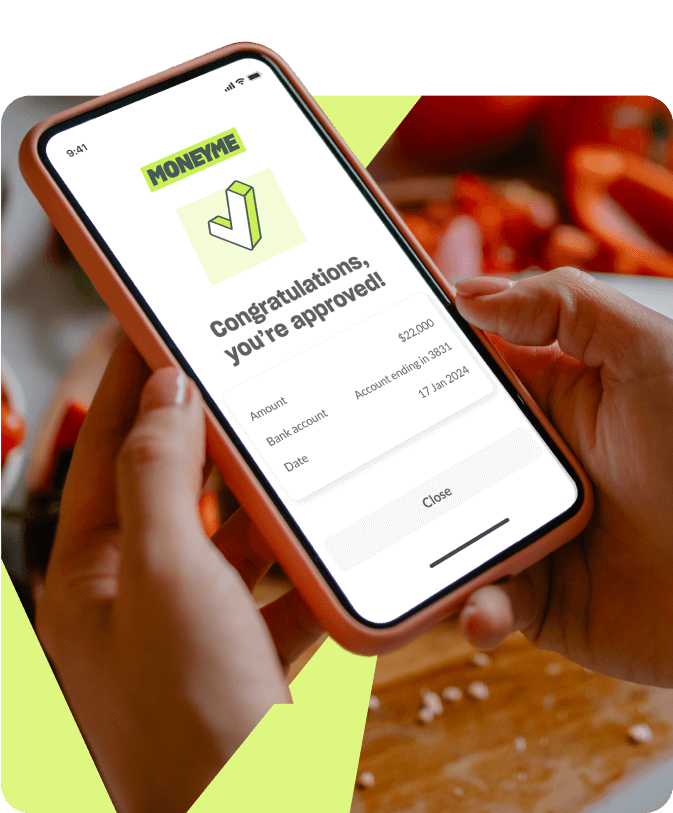

Depending on your vision and the existing quality and style of the room, a new bathroom cost can be a significant expense for homeowners and landlords. Luckily, MoneyMe and DVine Living are here to help.

Hosted by Dale Vine (of ‘The Block’ fame), DVine Living is a brand-new lifestyle series on 7Two. You can view every episode on the MoneyMe DVine Living page and learn the ins and outs of bathroom renos and many other DIY home improvement projects; and how you can maximise our home improvement loans to get the best bang for your (borrowed) buck.

The average cost to renovate a bathroom in Australia falls between $15,000 - $25,000 for a standard room. Your bathroom renovation cost needn’t break the bank, but it’s important to do your homework and make smart choices around materials and fittings, layout, install and where and when to spend on professional work.

If you’re simply looking to freshen up your bathroom space, you can achieve luxury bathroom style on a budget by modernising the colour palette. This can be easily accomplished through a fresh coat of paint on the walls, replacing the mirror, old tapware and fittings, resurfacing the bath or shower, and showcasing your personal style through eye-catching new accessories – all DIY jobs if you’re game!

Your bathroom fittings cost will increase rapidly once you begin to consider premium elements like porcelain tiles. While stunning and in style now, it can also be extremely expensive and labour intensive. To lower the cost, you might consider porcelain/ceramic substitutes or only using tiles for flooring and the walls immediately surrounding the basin, bath, and shower.

Any structural bathroom renovations involving moving water sources such as changing the layout of the shower, toilet, or basin; adding a floating vanity; or changing the lighting and adding electrical outlets; will require professional plumbing and waterproofing carpentry electrical work. This drives bathroom installation costs up but is mandatory to ensure quality control. Your renovation is completed to Australian building authority safety standards and is compliant with council and insurance protocols.

To make sure you’re getting the most competitive bathroom renovation costs Sydney, we recommend getting multiple quotes for the work you’re after, then adding in a contingency of around 10% - 15% for any unforeseen expenses on top of that. These will occur and typically account for materials and additional labour costs, which can occur when you begin to make structural changes – particularly in older buildings.