Car loans are very popular lending products, and you’ll find available offers absolutely everywhere. But how do you know which is the right lender for you? How do you choose the right car loan for your financial circumstances?

How much you want to borrow

When you buy anything, you usually set yourself a rough budget. When it comes to buying a new vehicle, try to stick with the budget that you have set yourself. Overextending yourself financially is a stressful and uncomfortable position to be in. You can use our online loan repayment calculator to help you work out what a comfortable cash loan amount to borrow will be and how to budget in your repayments while you’re paying off your loan.

Remember also that your new vehicle – whether purchased brand new or as a second-hand vehicle – is rapidly depreciating as soon as you take ownership. Spending too much on a vehicle may not only overextend you but may also turn out to be a failed investment, causing you to lose more money than you otherwise would have in the event that you sell your vehicle on.

Loan affordability

Once you know what your borrowing budget is, then it’s time to work out the most affordable loan term. Shorter loan terms will mean you pay less interest over the life of the loan, but the repayments will be higher than for long term loans. Use our online calculator to play with various loan terms until you land on a repayment amount that you can comfortably budget into your current living expenses, including your rent or mortgage repayments, other bills and debts that you owe as well as your everyday living and entertainment expenses.

Lenders

Choosing between lenders can be the most difficult decision. Most car finance products are similarly priced between lenders so what you’re really looking at when you are doing a car loan comparison is things like accessibility, online ratings and customer testimonials as well as perks, flexibility and ease of application and approval.

MoneyMe is the Gen Now lender. We specialise in making it as quick and easy as possible to get approved for the finance you need. We offer a range of options including medical loans and debt consolidation loans as well as unsecured car loans. Personal loan amounts are available for between $5,000 and $50,000.

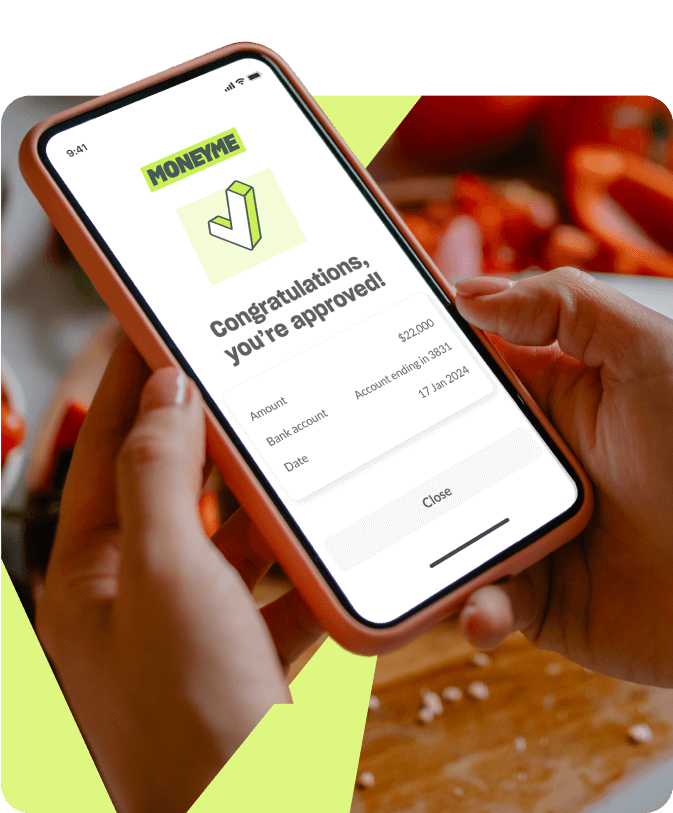

As a wholly online lender, we offer a wholly online application process that takes you less than 5 minutes to complete and submit. Customers who apply for our cash loans during business hours will typically receive a response in minutes. When you are approved, you’ll be sent a formal loan offer detailing your total approved loan balance, the interest rate you have been approved for as well as your repayment amount, frequency and any other fees and charges that apply. This loan offer is sent to you online and if you’re happy with the terms and conditions of your new finance then you simply digitally sign it online. Once you have signed your online loan offer, we transfer your funds immediately. For some customers, depending on who you bank with, this could mean that the cash you are looking for arrives in your bank account the same day that you applied for it.

We don’t charge our customers an early exit fee should they wish to pay out the balance of their loan with us before the loan term ends. This is just one way we like to reward our credit customers. It also means that you have the flexibility to refinance at a later stage, borrowing enough to pay out the rest of your car loan balance with us plus whatever new funds you were looking for, without additional fees. Or, alternatively, you could simply pay out your loan balance early with us and enjoy saving yourself some interest payments along the way.