To be eligible for a variable rate personal loan from MONEYME, you must be at least 18 years of age, currently employed and a permanent resident in Australia or New Zealand.

Our online application form will ask you standard lending questions like details of your income, mortgage payments for home loans or rental payments if you're a renter, as well as any other bills and debts that you currently have. You'll be asked to state your ideal borrowing amount and what the purpose of your loan is such as whether it is for car finance, etc.

As part of our standard practice, your credit report will be accessed to help us understand what kind of credit history you have. Your credit report is just one part of your application, and all applications are thoroughly assessed.

Don't worry if your credit report isn't quite as good as you'd like it to be. We understand that your credit history does not present a full picture of your financial status. Your credit file, however, will likely affect the total cost of the loan that you apply for. Weaker credit files will usually attract a higher unsecured personal loan interest rate.

Remember that you can reduce the amount of loan repayments that you make by paying out your balance ahead of time. We do not charge fees for repaying your unsecured loan balance early. Ensure that you take this into account when you compare personal loans.

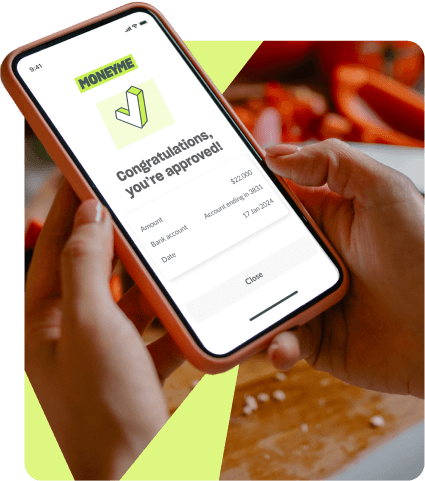

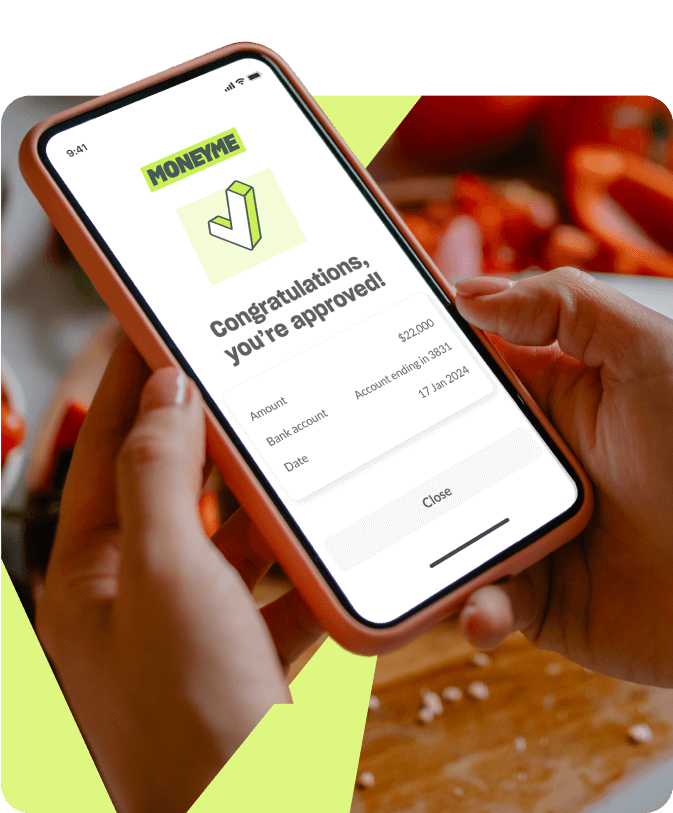

Approvals are often received within minutes when you apply for a MONEYME personal loan during our business hours. Once your loan amount is approved, the funds will be in your bank account on the same day, and within minutes in some cases.