If you are looking to take out personal loans or apply for a credit card, obviously you’ll want your credit score to be as high as possible to help you get favourable terms and a low interest rate. So how can you boost credit score? Not all credit scoring agencies will calculate credit score exactly the same way, but if you are wondering how to improve credit score, there are some suggested measures you can take. Whether it’s your mortgage, rent, credit card, or utility bills, if your credit score is low, one step you can take to try to improve your credit score is to ensure you pay your bills and payments on time. Paying your credit card back on time can not only help you improve your credit score but can also help you to avoid late fees or paying any extra interest. If you pay back extra money on top of the minimum repayments or pay back the amount in full each month, you’ll save even more money on interest. If you have several credit cards and loans, it may be worth considering consolidating your debts as this may make your repayments easier to manage.

Other ways that may help with rebuilding credit score are lowering your credit card limit and limiting how many credit applications you make. Even if your credit card or loan application gets declined, the application will still appear on your credit report. If you make a lot of applications in a short space of time, this might indicate an issue to your bank or money lender, and it may negatively impact your credit score.

If you think your credit score is higher than it should be, it could be worth doing a credit score check to make sure all the information that has been recorded in your credit report is accurate. For example, the amount of a debt may be incorrect or a debt may be reported twice. If the credit reporting agency has made an error, you can contact the credit reporting agency directly, and they should be able to fix it for free. They can also update any personal information such as your name, address, or date of birth if this is incorrect. If it is your credit provider who has reported incorrect information, you can contact them and ask them to get the incorrect information removed. There may be a delay between when your lender reports your information to the credit reporting body, so repairing credit rating may not happen immediately. To find out more about fixing errors on your credit report, head to ASIC’s Moneysmart website.

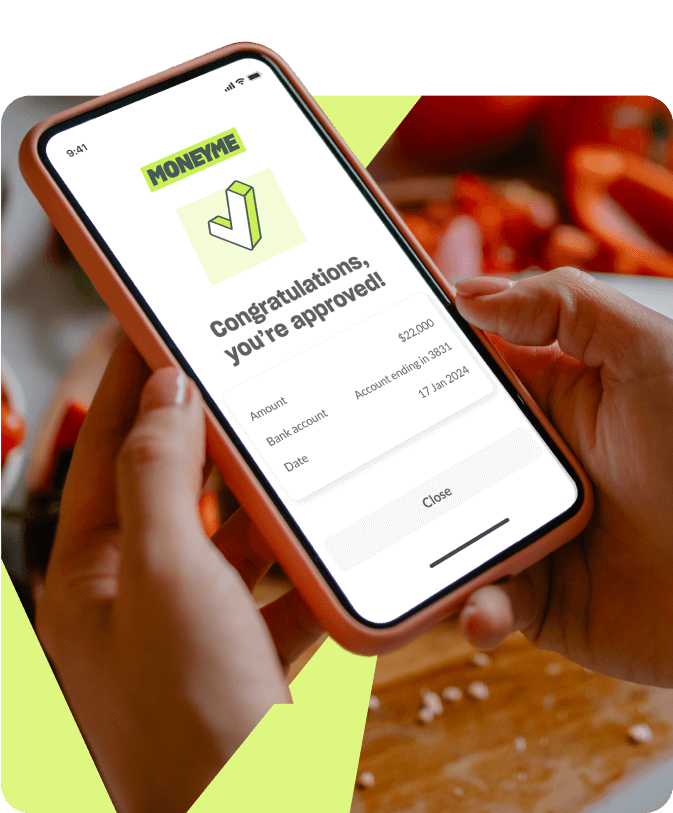

Another good way to improve your creditworthiness is to build a good relationship with your money lender. As well as using a credit score that has been worked out by a credit reporting body, some lenders may calculate their own score. For example, if you are applying for a MONEYME personal loan or a Freestyle virtual Mastercard, we give our customers a MONEYME loan rating score from A1+ to A5+ that is mainly determined by your credit history. Every time you take out a MONEYME loan and make your repayments on time, you can improve your MONEYME loan rating. By doing this, you may be able to borrow at a lower cost next time you apply for a MONEYME product. At MONEYME, we like to reward our customers for a good repayment history.

MONEYME is a responsible lender, so although we will conduct a credit check when we are assessing your loan application, this doesn’t mean we automatically decline anyone who has a mark on their credit file. We also look at the big picture and understand that you may have good reasons for your situation or your financial circumstances have improved. Even if we decline your application the first time round, for example, if you are bankrupt, have a poor credit history, or in a debt agreement, you are very welcome to apply again at a later date if your situation changes, and hopefully next time your application will be successful.