It’s a common misconception that banks or other financial institutions are the only ones able to tell you ‘what is my credit score’, that a credit score check costs money, or that you can only find out your credit health by making an application for a loan or other credit product.

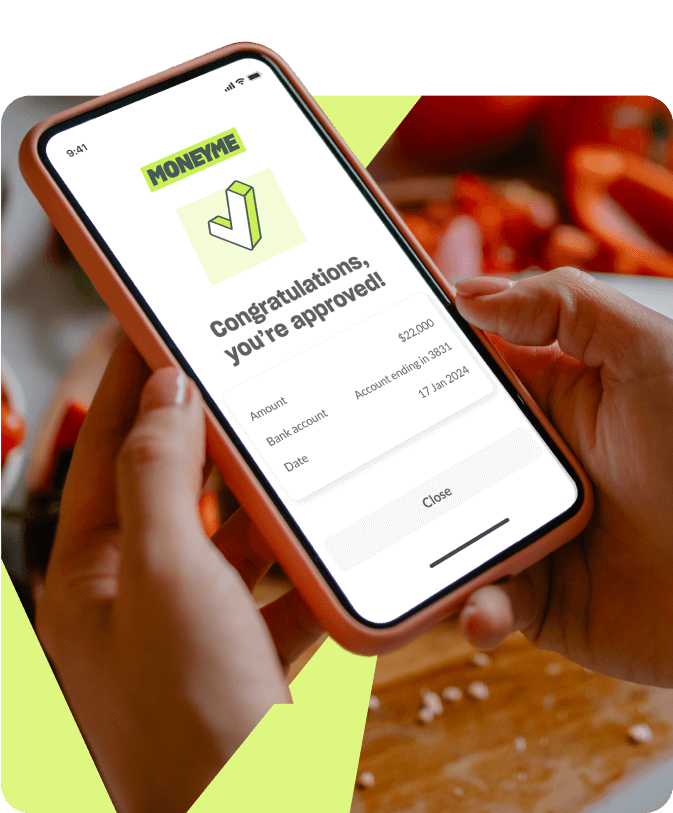

Using MoneyMe’s new credit score finder is the most convenient method of how to check credit score – and it’s 100% free of charge.

Simply visit us online and provide the necessary information for us to legally identify you through our secure digital credit portal, and we’ll deliver an up-to-date credit report direct to your email reflecting the last five years of your credit behaviours.

Using your free credit history, combined with your current financial status, you can assess whether you’ve got a good credit rating and are in a reasonable position to apply for credit, or if you need to wait and boost credit score first.

A key part of checking your credit score is ensuring there aren’t any inaccuracies on your record that could be bringing your score down unfairly. This might look like loans or credit cards that you haven’t applied for – and is typically a sign that someone has attempted to use your identity to illegally obtain credit. In such instances, you’ll need to contact the Australian Financial Complaints Authority to notify them of identity theft and to raise a dispute with your credit provider. Getting these applications – and, in some instances, debts – removed from your record is an important start on how to improve credit score.

If your credit report is clean of any fraudulent activity, it’s time to start looking at the lines of credit you currently have open – such as personal loans, a mortgage, credit cards, payday loans, buy now, pay later accounts – and your repayment habits.

Here are the top five things you can do to improve your credit score: