If you’re learning more about your finances, you might have asked, ‘What is a credit score?’

A credit score, also called credit ratings or credit scoring, is the number or rating lenders use to determine your creditworthiness as a borrower. In Australia, the three major credit reporting bodies that collect and store financial data about you are illion, Equifax, and Experian.

At MONEYME, we use credit scores to calculate credit card and loan interest rates. In general, having an excellent score can give you access to more favourable credit cards, loans, and other financial options. But as an innovative finance solutions provider, we understand that some people have lower ratings due to reasons that are out of their control.

For instance, individuals who are in a younger age bracket have lower credit scores simply because they haven’t spent enough time to build positive credit actions like making timely payments or sensible applications. For this reason, our approval process is done on a case-by-case basis.

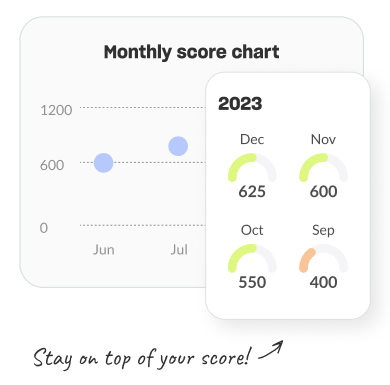

At MONEYME, we even offer a convenient mobile app where you can check your score in minutes for free and get personalised insights about your credit report.

Learn more about credit scores and receive tips on improving them below.

What’s a good credit score?

Now that you have understood the answer to ‘What is a credit score?’ the next step is to learn ‘What is a good credit score in Australia?’

When it comes to how they calculate credit scores, different credit bureaus have their own methods and ways of reporting. In general, your score will be a number that ranges from 0 and 1,000 or 0 and 1,200, depending on the credit reporting agency. Their rating is fairly simple and straightforward – the higher the score, the better.

So, what is a good credit score? The exact number will differ based on the credit reporting agency. As an example, take a look at each credit score rating based on illion’s rating system below.

Perfect score (1,000)

Only a small percentage of Australian borrowers belong to this exclusive group, whose members are more likely in an older age bracket and have spent a lifetime building an excellent credit history through timely payments, sensible applications, and just the right amount of credit lines.

If you’re part of this exclusive group, you’ll enjoy better credit and loan interest rates than your lower-rated peers.

Excellent score (800–999)

For borrowers with this type of score, lenders performing a credit health check will generally approve applications and offer favourable rates because they have demonstrated their ability to pay their loans without delays.

Very good (700–799)

Lenders performing an online credit check will generally perceive credit scores between 700 and 799 as ‘very good’. While borrowers with this rating have no problem getting their applications approved, they may not enjoy the same excellent rates as individuals with higher credit scores.

One way to improve your credit score is to limit the number of credit applications. Remember, too many of these, and you run the risk of having a lower credit rating.

Average (500–699)

If you’re wondering, ‘What is a credit score that’s perceived to be average?’ it’s generally between 500 and 699. Most lenders feel that this is an ‘acceptable’ level because it shows that you haven’t had any major credit mishaps like bankruptcies or defaults.

But if you want to access better credit and loan rates, you need to improve your credit score by avoiding late payments and limiting the number of credit applications.

Fair (300–499)

While this credit score level is below average, it often means borrowers don’t have major issues like bankruptcies. Usually, people who belong to this category are young people who are still in the process of building their credit history.

Low (0–299)

If you belong to this credit score bracket, you probably have negative data on your credit history, like payment defaults and/or frequent late payments. Fortunately, you can improve your rating by paying your bills on time, avoiding making multiple credit applications, and waiting for any defaults to be cleared from your record (which usually takes around five years).

What are the benefits of having a good credit score?

Borrowers are not just curious about ‘What is a credit score?’ They also wonder how it could give them a wide range of financial benefits, especially when it comes to saving money and getting access to favourable loans and lines of credit.

Higher borrowing capacity. If lenders conduct an online credit check and find that you have a high credit score, chances are they’ll let you borrow more money because you have already demonstrated your ability to meet your repayments on time.

Better negotiating power. In general, borrowers with a high credit score have more negotiating power than those with lower ratings, allowing them to access more favourable loans and credits. Nonetheless, your credit rating is just one of the few criteria lenders take into account when calculating your interest rates, so having a high credit score is not a 100% guarantee that you will automatically get lower rates.

Increased chance of loan or credit card approval. While lenders use different factors to determine your creditworthiness, having a higher credit score increases your chance of getting more favourable rates than your peers with lower ratings.

Tips for improving your credit score

Apart from knowing ‘What is a credit score?’ and ‘What is a good credit score?’ it’s crucial to understand how to conduct a credit score check and how to increase your credit score. Whether you have a high or low credit score, there are things you can still do to improve your creditworthiness. If you want to know how to improve your credit score and put yourself in a stronger financial position, read our tips below.

Pay debt repayments on time.

Paying your debt repayments on or before the due date is one way to create a good credit history because it demonstrates your ability to meet your financial obligations in a timely manner. But if you struggle with this one, why not consider setting up a direct debit from your bank account or automating your payment? This way, you don’t have to worry about getting caught up with late fees.

Limit your credit enquiries.

Remember that every time you apply for new credit, this enquiry stays on your record. Thus, you don’t want to have too many credit enquiries in a short period, which many lenders interpret as an activity of someone struggling to get approved, even if, in reality, you are in decent financial standing. To avoid this issue, only proceed with a credit card or loan application when you’re sure you’re ready to do so.

Find out your credit score from all major credit reporting agencies and look for any inaccuracies.

The three big credit reporting bodies, illion, Equifax, and Experian, collect and store information about you and your finances and use this data to make your credit report and calculate your credit score, which lenders use to figure out your risk as a borrower.

You can ask for your credit report for free once every three months from each of these big reporting bodies so you can look for any irregularities. For errors in your credit report, such as inaccurate reporting by the credit provider or the credit reporting agency, you can reach out and request to get these fixed.

But did you know that there’s an even simpler way to keep track of your credit score?

With MONEYME, you can use our Credit Score tool on the MONEYME mobile app to get a free and fast personalised credit check. You’ll get to see the same details that banks and lenders use to check your creditworthiness, and you’ll also get access to tips and tricks to make your score better, along with special offers too.

To get started, just download the MONEYME app (you can find it in the Apple and Google stores) and enter a few basic details like your name, number, email, date of birth, address, and driver’s license number (optional). It’s that simple to get started with the MONEYME app and check your credit score.

In summary, taking control of your personal finances means understanding what a credit score is and how you can work on improving yours.