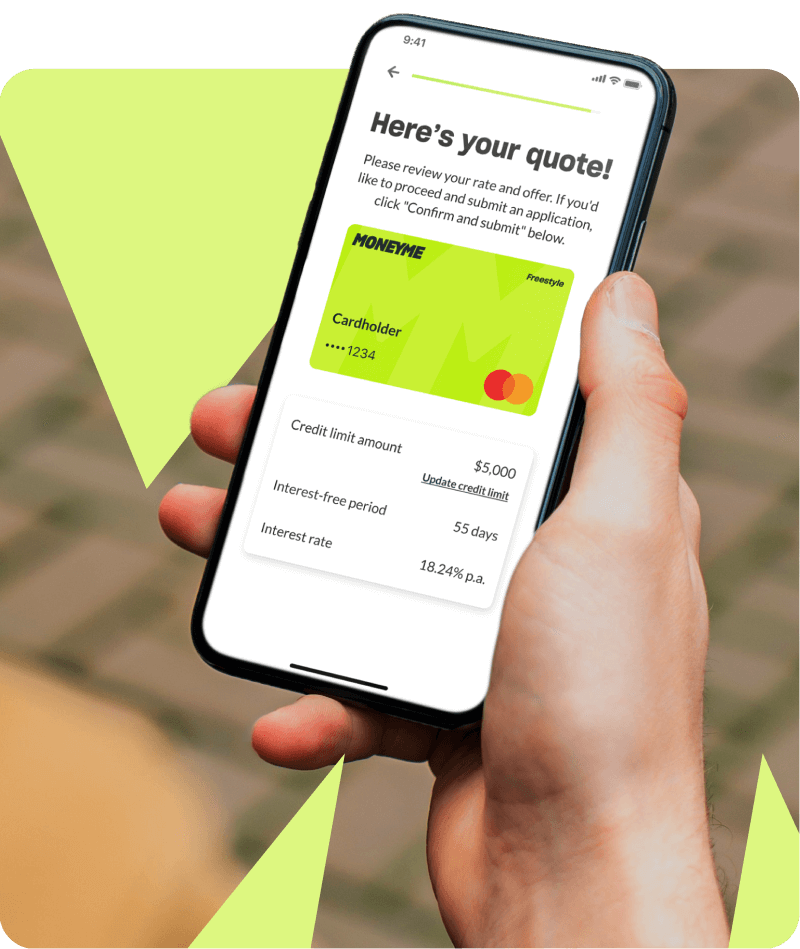

With rapid line of credit Brisbane approvals and instant access to credit limits of up to $5,000 for approved applicants, MoneyMe’s Freestyle virtual Mastercard® is a great way to get flexible cash fast. MoneyMe is the award-winning face of modern money lending. We’ve ditched the documentation and gone digital, operating 100% online - no paperwork, no phone calls, no fuss.

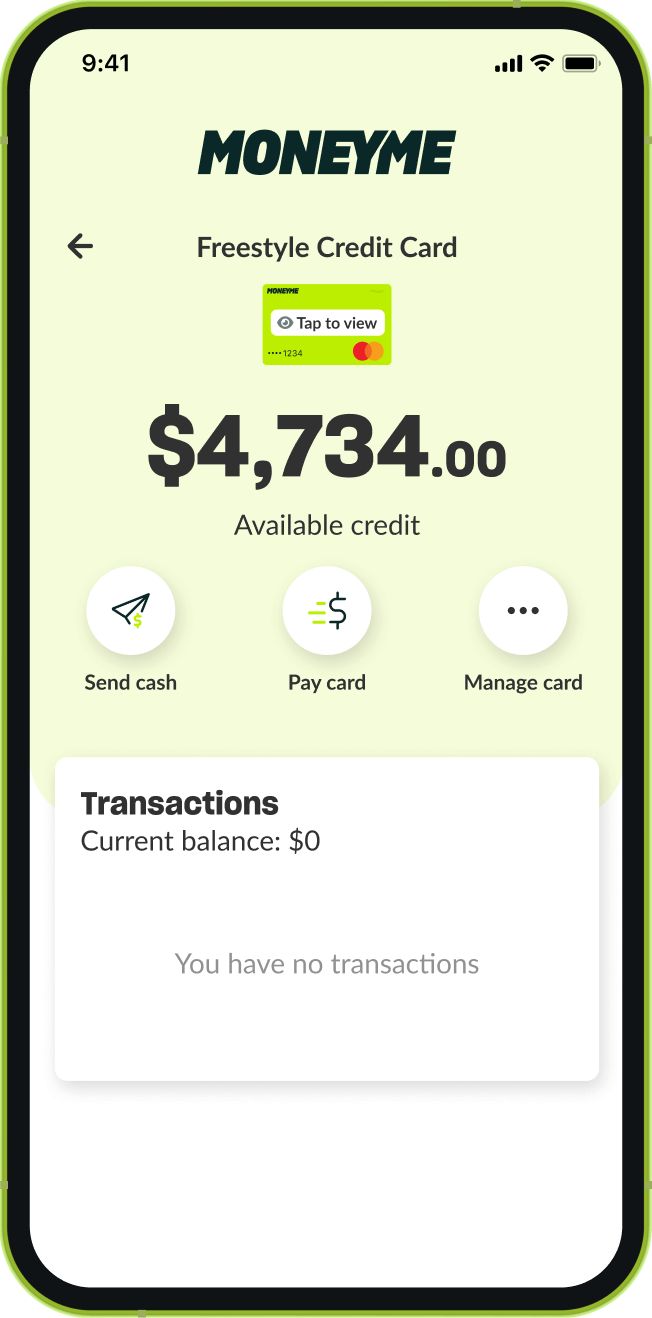

We’re totally mobile, and that means you are too. You can apply for a line of credit Brisbane - or one of our small personal loans - online and manage your money from the convenience of a handheld device anywhere, any time using the MoneyMe app.

It takes less than 5 minutes to apply for a line of credit with us. We utilise advanced lending technologies to fast-track the outcome of your secured line of credit application.

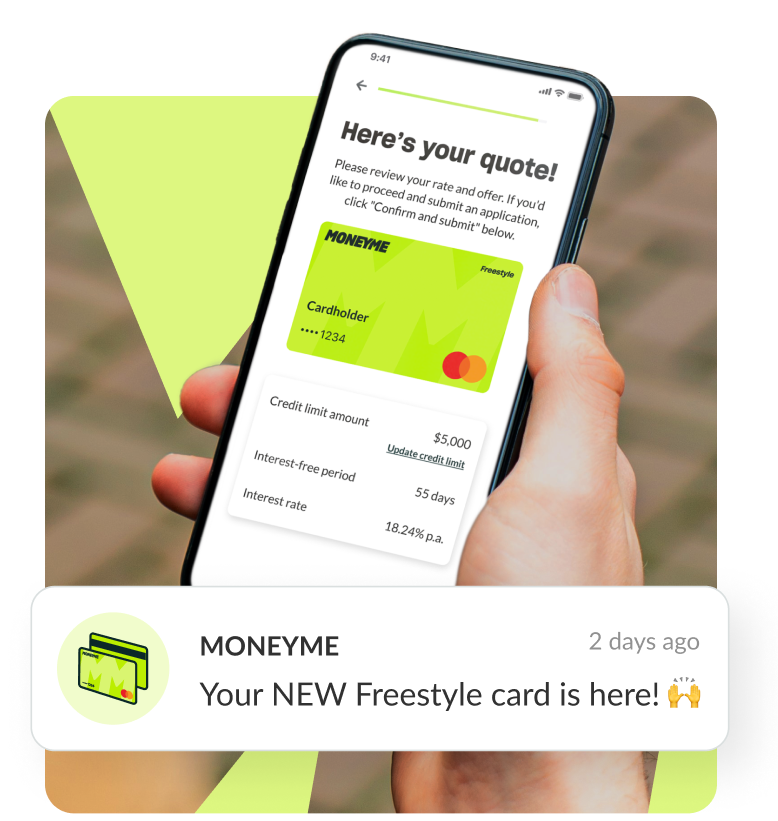

Gone are the days of agonising waits - you’ll know almost immediately if you’ve been approved for our Freestyle virtual Mastercard® and, assuming you’re successful and applied within business hours, you’ll have access to your funds immediately.

Being virtual, your new card won’t take up space in your wallet. You’ll be able to use it to shop in-store using Tap N Pay on your smartphone, make online purchases in seconds with Freestyle partners, send money straight to your bank account, and soon even make peer-to-peer payments on the spot - anywhere, any time.

Now that’s fast, flexible cash! To find out ‘how much can I borrow?’, apply online using the MoneyMe app today.