A MoneyMe home improvement loan is a great way to finance your bathroom remodel cost.

Our loans are only offered with a fixed interest rate, which means you’ll know exactly how much your repayments will be for the full duration of your loan term. Our customers find this a huge help when considering their home renovation budget in the greater context of long term financial planning.

Our online loan calculator is a great tool to help you budget. Whether you’re only seeking funds to cover your bathroom installation cost or are also considering including other home improvements like a kitchen renovation cost, patio cost or verandah cost, our loan calculator will let you compare a variety of loan amounts over different periods of time.

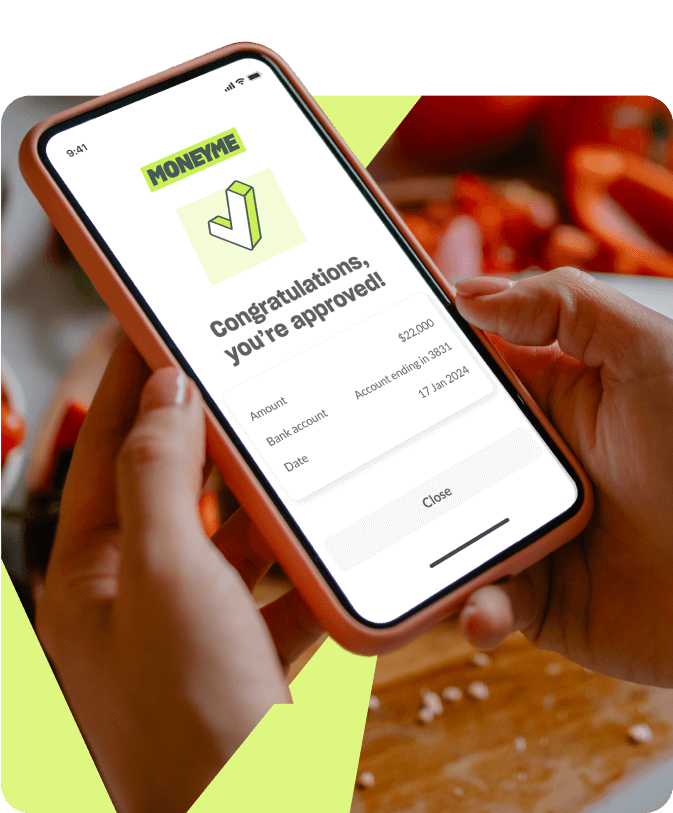

To be eligible to apply for a MoneyMe personal loan, you’ll need to be at least 18 years of age and an Australian citizen or resident for tax purposes. We’ll ask you about how much you’d like us to lend you for your bathroom remodel cost and over how long. Once we know that, you’ll need to tell us about your employment and income, daily expenditure, and any liabilities, savings, and assets.

We’ll also run a quick check of your credit history. It‘s worth noting that credit reporting has changed - and we reckon it’s definitely for the better. The new method reflects all your positive credit behaviours, like consistent positive repayments, and not just your debts and defaults. This gives us an accurate picture of your current borrowing capacity and makes the loan assessment process much fairer.

Alternatively, you may consider covering your renovation costs with a credit card or line of credit. The MoneyMe Freestyle virtual Mastercard © offers credit of up to $20,000 to approved applicants. Accessed exclusively via your smartphone, you can use the card both online and in-store via Tap n Pay or even transfer funds straight to your bank account.

It’s worth remembering that credit cards have a higher interest rate than personal loans. Still, if you’re able to make the full repayments within the 55-day interest-free purchase period, they can be one of the handiest tools in your home renovation toolbox.