Non secured loans—also known as unsecured loans—are loans that don’t require any assets such as a property, car or investments to be provided as collateral or security for the loan. Instead, unsecured financing such as personal loans and credit cards rely on a borrower’s creditworthiness. In contrast, with a secured loan you need to provide an asset as security, and then if you default on your repayments, the lender can take possession of your asset and sell it to help recoup the cost of the loan. Secured loans are commonly used for mortgages (where the property becomes the collateral) and car loans (where the lender will take ownership of the vehicle if you default on your loan).

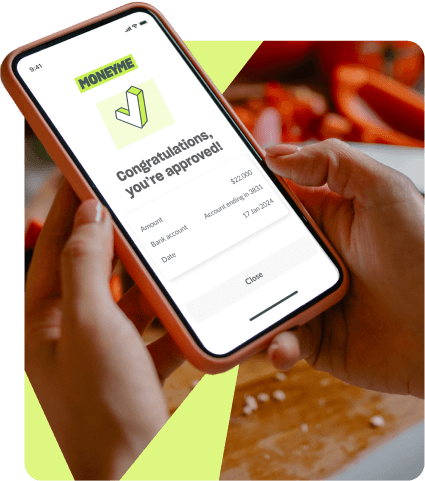

One of the advantages of unsecured cash loans is that the borrower is not risking losing a house, car or other assets if they are unable to meet the loan repayments. Although if a borrower fails to meet repayments on an unsecured loan, even though the lender won’t have the right to take any possessions, they would still most likely try to recoup the money in other ways such as taking the borrower to court. Another advantage of non secured loans is that the funds can be used for a variety of purposes unlike a car loan or a home loan where you are limited to what you can spend your money on. In general, the application process for no collateral loans can be much quicker, and in some cases, you can get access to your funds on the same day you apply. With non secured loans, you’ll also often have more flexibility around your repayment terms than you would with a secured loan.

One disadvantage of unsecured lending is that because loan companies perceive it to be riskier, unsecured loan rates are usually slightly higher than the interest rates on secured loans. In most cases with unsecured personal loans, the borrower will need to have a higher credit score for the loan to be approved. The lender will also look closely at other factors such as income to determine whether the borrower can afford to make their repayments. Competitive interest rates are still possible with unsecured personal loans, especially if you have a good credit rating. If you make all your repayments on time, a personal loan can be an effective way of improving your credit score. On the flip side though, if you default on your payments, this will have a negative effect on your credit score.

You’ll need to weigh the pros and cons and look at your particular financial circumstances to decide what type of loan is best for you. If you are looking for unsecured last minute loans, MoneyMe offers fast loans up to $50,000 with low rates and flexible repayments.