It could be you’re tying the knot, having your first child or getting promoted. Let’s face it, weddings aren’t cheap and moving home for the first time is absolutely costly especially if you’re moving to a far state. And if you’re expecting a new member of the family, the grocery list expands and your pediatrician visits become more frequent. For whatever reasons, Australians apply for personal loans to have a little extra cash on hand on top of their savings to prepare for life’s bigger things.

Before applying for a personal loan, make sure that your loan purposes are reasonable and necessary. You also have to consider your ability to make repayments comfortably to prevent you from getting into bad debts.

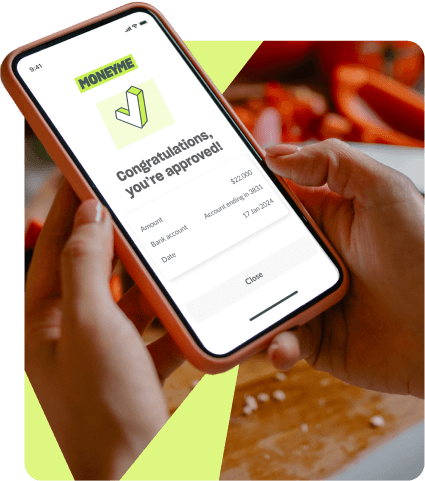

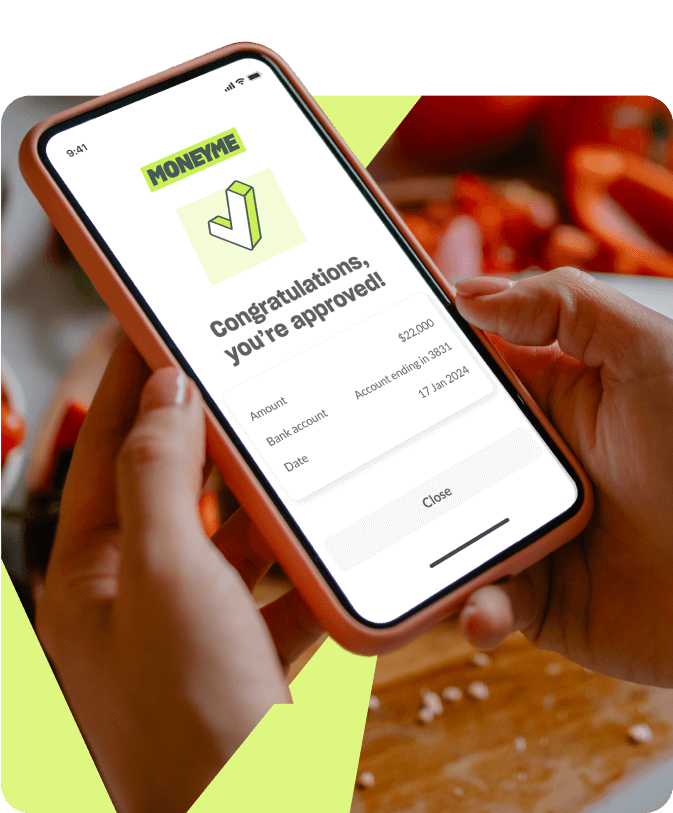

MoneyMe offers low rate personal loans for all these, and more. With a super-fast online application and outcome, you can borrow and have the money in your account in as little as 60 minutes. Get loan rates tailored to your circumstances and make effortless repayments using our mobile app. MoneyMe gives you access to up to $50,000 so you can manage your debts, upgrade your home, and pay for school fees in no time without paying anything upfront.

And if it’s more financial flexibility you’re after, MoneyMe’s Freestyle virtual Mastercard® has the convenient perks of a credit card (but with extra cool features) that allows you to Tap n Pay in-store, shop online with up to 55 days-interest free on purchases. You can also use it to transfer money to friends using just your mobile and get credit back offers at over 1,400+ stores in Australia.

Choose the finance option that best suits you. For better borrowing and digital credit card experience, apply with MoneyMe today.