If you’re thinking about applying for a loan or credit card, you’re probably also wondering what is a good credit score in Australia. It’s hard to give an exact number or rating because each credit reporting agency has its own way to calculate credit scores. But in general, their credit score rating ranges from 0 and 1,000 or 0 and 1,200, depending on the credit reporting agency.

It typically follows a simple rule: the higher the credit score range, the greater the likelihood of getting your loan or credit card application approved.

But the questions remain: What is a credit score and why is it so important?

It’s a very simple concept. A credit score, also called credit rating, predicts how likely you are to repay your loan or debt on time. Thus, lenders use it to decide whether to approve your application and use it to compute your interest rates.

What affects your credit score?

Many people wonder how is a credit score calculated and how it affects their ability to access loans and lines of credit, especially those with favourable rates and repayment terms. Again, it’s hard to give an exact number because credit reporting bureaus use different criteria to assess your reliability to pay back the borrowed money based on your previous repayment activities.

To calculate your credit score and establish ‘what is a good credit score in Australia’, credit reporting agencies typically use the following factors:

- Your past and present debts, including defaults and late payments, will have a significant impact on your credit score range.

- Your credit score chart is also based on your past and current loans, including personal and business loans. Credit reporting agencies also take into account whether you’ve been a guarantor for someone in the past.

- The agencies consider your existing credit limit, which is the maximum amount of credit card that a bank or any financial institution extends to you.

- Your credit cards and store cards, particularly how you repay your balance, influence your personal credit rating.

- The bureaus also review your closed and existing accounts.

- Any history of bankruptcy or any default judgement against you has a negative effect on your credit score range.

To give you an idea of ‘What is a good credit score in Australia?’, illion defines an average credit score as anything between 500 and 699, while anything above this range is considered good and excellent. Meanwhile, anyone with a perfect score of 1,000 is considered a financial unicorn, since only around 3.5% of Australian borrowers belong to this exclusive group.

How to improve your credit score?

Now that you have an idea of what is a good credit score in Australia, the next step is to know how to improve your credit score through positive financial activities that are explained below:

- Make sure that you always pay on time. If you occasionally overlook your due dates because of your busy schedule, it’s highly advisable to automate your payment or set up a direct debit from your bank account.

- If you think you won’t be able to pay off some of your bills, be sure to reach out to the provider for your options. Many companies offer different financing options like payment plans and financial hardship arrangements, which can help save your credit score.

- Don’t apply for too many loans and lines of credit. Besides wondering about what is a good credit score in Australia, many borrowers are also confused about ‘how many is too many’ when it comes to credit enquiries. Lenders generally interpret that applying for six or more enquiries in a short period is a sign that someone is struggling to get approved or experiencing some financial woes.

- Once you learn how to check your credit score, the next step is to compare your credit score and history based on the ratings of the three major credit reporting agencies in Australia. And if you see anything that stands out or looks like an error, ask them about it and possibly have it corrected immediately.

How to get credit score?

Aside from the question, ‘What is a good credit score in Australia?’ borrowers are also curious about how to obtain their credit scores. There are three main credit reporting bodies that gather and store your financial data: illion, Equifax, and Experian. They use this data to create your credit report and determine your credit score, and this rating helps lenders figure out your risk level as a borrower.

Once every three months, you can ask for your credit report from each of these reporting bodies for free.

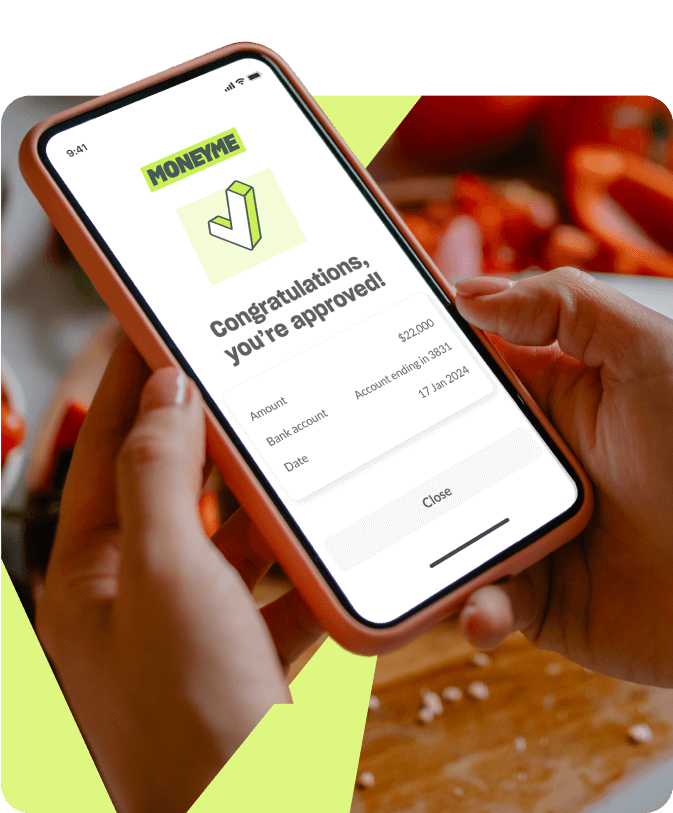

If you’re interested in a simpler way to track your score, look no further than MONEYME. With us, you can use our Credit Score tool on the MONEYME mobile app to get a free and quick personalised credit check.

You’ll see the same data that banks and lenders use to evaluate your creditworthiness. Plus, you’ll get tips and tricks to improve your score and access to special offers. To get your score, just download the MONEYME app from the Apple or Google Play Store and provide some basic information like your name, contact number, email, DOB, address, and driver’s licence number (optional).