When it comes to evaluating your personal finances, understanding what is a good credit score is a great place to start. But just what is a credit score? Simply put, your credit score is a numerical representation of the risk you present to lenders should they agree to lend you money. Generally, your credit score will fall between 0 and 1,000 (or 1,200, depending on which credit reporting agency you use).

So, what is a good credit score? It is one that’s achieved through consistent, timely repayments on your lines of credit, such as a mortgage, personal loan, or credit card, as well as things like utility bills. The higher your credit score, the less risky lending to you seems – and the more likely they are to release credit to you at low interest rates and better terms.

The lower your personal credit rating, the more likely you are to be offered less credit at higher interest rates – or declined outright in your credit application, depending on your specific circumstances. That’s because a low credit score generally reflects a history of late payments or defaults, multiple applications for credit within a short period, or other inconsistencies related to your finances and debts.

There are three main credit reporting bodies in Australia that collect and store financial data about you: illion, Experian, and Equifax. These data are collected to create your credit report and calculate your credit score, which lenders use to assess your borrowing risk.

Your Equifax credit score rating will be reflected as a number between 0 and 1,200. As a guide, Equifax ranks their credit score brackets as follows:

- 0–509 = Below average to average

- 510–621 = Average

- 622–725 = Good

- 726–832 = Very Good

- 833–1,200 = Excellent

Equifax will calculate the credit score upon evaluation of your credit history report. The credit history report documents how many different types of credit you’ve applied for – such as loans or credit cards – the amount you applied for and when, the outcome of those applications, any debt you currently have, and your repayment history against those debts. It will also identify any bankruptcies of court judgements against your name.

Given this, what is a good credit score in Australia? When looking at your credit score and considering if it’s a good rating, it’s important to allow for context. Wealth and assets aren’t necessarily equivalent to a good credit rating.

In fact, a new homeowner is likely to have a lower credit score than a student with their first credit card due to the amount of debt they have taken on through their mortgage. Each bank will have its own parameters for what is a good credit score, but generally, a credit score of around 622 and above is considered good under Equifax’s reporting.

It’s free to request your credit report from each of the major credit reporting agencies mentioned above every three months. But there’s an even easier way!

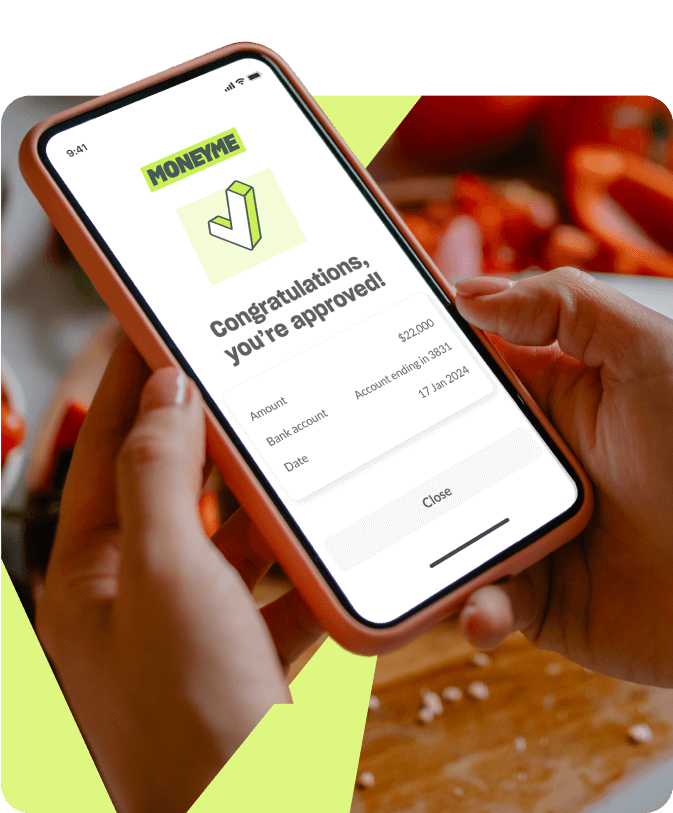

You can get a credit score check quickly from the MONEYME app by using our Credit Score tool. With the MONEYME app, you can check your score in minutes for free and get personalised insights into your credit report. You’ll get access to information that banks and lenders use to evaluate your creditworthiness, tips and tricks to improve your score, and even special offers.

To get your score, simply download the MONEYME app (available on the Apple App Store or Google Play Store) and enter your name, number, email, DOB, address, and driver’s license number (optional).

What affects your credit score?

There are a number of factors that can negatively impact your credit score average. These include the following:

- Defaults or missed payments on your personal loan, mortgage, or credit card repayments

- Excessive applications for credit products within a short period, resulting in numerous hard checks by lenders

- Late payments on utility bills or buy now, pay later facilities

- Suspicious patterns of balance transfer applications

- Payday loans

- Court judgements or filing for bankruptcy

How to improve your credit score?

Your searches for ‘how to improve my credit score’ show your interest in enhancing your own score, and the best way to do it is to demonstrate consistent, positive credit behaviours.

You can do this by paying your bills and making repayments by their due date, reducing the lines of credit you are accessing (e.g. multiple ‘buy now, pay later’ accounts and credit cards), avoiding payday loans, and not applying for multiple credit products within a short period. Closing any accounts you pay off is also a good way to improve credit, as it demonstrates you are combating your debt strategically.

If you’ve been wondering, ‘What is a good credit score?’ it may also be a good idea to speak with a financial advisor or counsellor early on – regardless of your financial circumstances. Far from just being for the rich, financial counsellors are able to look at your life holistically as well as financially and help you understand, plan, and establish better behaviours surrounding your finances.

If, during your financial evaluation, you realise you’re stuck for repayments on any line of credit you may have, contact your lender or credit provider immediately to let them know. It’s crucial to do this as soon as you realise you won’t be able to pay your bills on time. This is because when you miss a payment on a line of credit, the default gets recorded on your credit record and will remain there for years.

When you’re under a formal financial hardship arrangement or equivalent, the missed repayments don’t get recorded and won’t be added to or impact your credit score for the duration of the agreement.

Consolidating your debts into a single loan can also be a good way to make your monthly repayments more affordable and make establishing consistent repayment patterns easier. As long as you don’t end up paying more over time due to higher interest rates or a longer loan term, debt consolidation loans can be a great tool to help you get back on your feet.

Above all, remember that demonstrating consistent, positive credit behaviours – such as making those regular, timely repayments – is the best way to demonstrate your reliability as a borrower. The more of these you demonstrate, the better your credit score will become. Simple as that – there’s no need to keep searching for terms like ‘how to increase my credit score’ online anymore.

What is Comprehensive Credit Reporting (CCR)?

Comprehensive Credit Reporting (CCR) is a relatively new consumer credit report method that collects, analyses, and includes positive credit information in the credit history and generation of a credit score for any given consumer.

Previously, Australia operated on a reporting system that only focused on a customer’s negative credit management, such as serious infringements, as well as any credit enquiries they might have made (e.g. applications for credit cards or loans). This was recognised to be not just limited in the scope of assessing a customer’s suitability for a new credit product but also incredibly prohibitive to those who had experienced financial hardships and were attempting to rebuild their credit score.

The introduction of CCR means that the data included in a credit report is much more up-to-date. A credit report compiled under CCR now contains the typical enquiries and infringement history but also much more relevant information, such as detailed repayment histories, the dates accounts were opened and closed, credit limits awarded and if they had been voluntarily reduced, and so on.

All of this information serves to provide a much more comprehensive and accurate borrower profile to lenders. The recognition of positive repayment patterns also benefits consumers who have taken responsibility and are working hard to repair damaged credit or simply to improve their credit score and increase their chances of application success.

In summary, to take control of your finances, understanding ‘What is a good credit score?’ is essential.