A cash advance in Sydney is a type of cash loan that comes in a variety of forms. Your employer may issue a cash advance on wages you have not yet earned but will be earning soon. This means that you get paid earlier than you normally would and repay your employer with hours worked.

When we’re talking about a cash advance in the context of a line of credit then often it refers to either the ability to transfer a cash amount from your credit card to your normal bank account or a short term loan Sydney from a credit provider. Small loans can be a great way to help you get over a minor cash flow issue like when you have to move to a new rental property or when you need to pay out for unexpected expenses like urgent mechanical repairs, urgent travel and accommodation or other little life events that inevitably catch us all a little unaware sometimes. At MoneyMe, we offer customers a range of personal loans ranging from $5,000 through to $50,000. You can take our quick loans over a period of as little as 12 months right up to 5 years depending on how much you borrow.

The other type of cash advance in Sydney is issued from your credit card. A credit card like the Freestyle Mastercard from MoneyMe is a multi-purpose revolving line of credit. It allows you to purchase items both in-store and online using your credit funds and then extends up to 55 days interest-free on those purchases. This means that you have up to 55 days to repay the funds that you have used and avoid paying any interest on that credit amount. Essentially, when you repay your credit balance used on purchases within the interest-free period, you are using an interest-free line of credit. If you compare this interest-free period with popular buy now and pay later options in-store then you’ll find that you’re often getting almost an entire fortnight extra in interest-free repayment time plus the ability to use your Freestyle online credit card anywhere that Mastercard is accepted (generally more places than buy now and pay later options).

If you want to transfer a cash amount from your Freestyle account, then you are using the credit facility known as cash advance. Freestyle allows you to transfer an amount directly from your credit card to your own or another person’s bank account all from your mobile device. Unlike purchases made, however, it does not come with an interest-free period so it’s important to understand all of the fees and charges as well as the interest and terms and conditions of cash advance before you opt for this type of credit option.

If you are considering transferring a cash advance from your credit card, why not take a few moments to quickly check whether one of our fast loans in Sydney might not be the better option?

You can use tools like our online personal loan repayment calculator to get an idea of the kinds of repayments you’ll need to make for our same day loans in Sydney and quickly build a budget comparing your options. Everything you need to know about our range of loans is available to view on our website, including all the fees and charges as well as indicative interest rates offered.

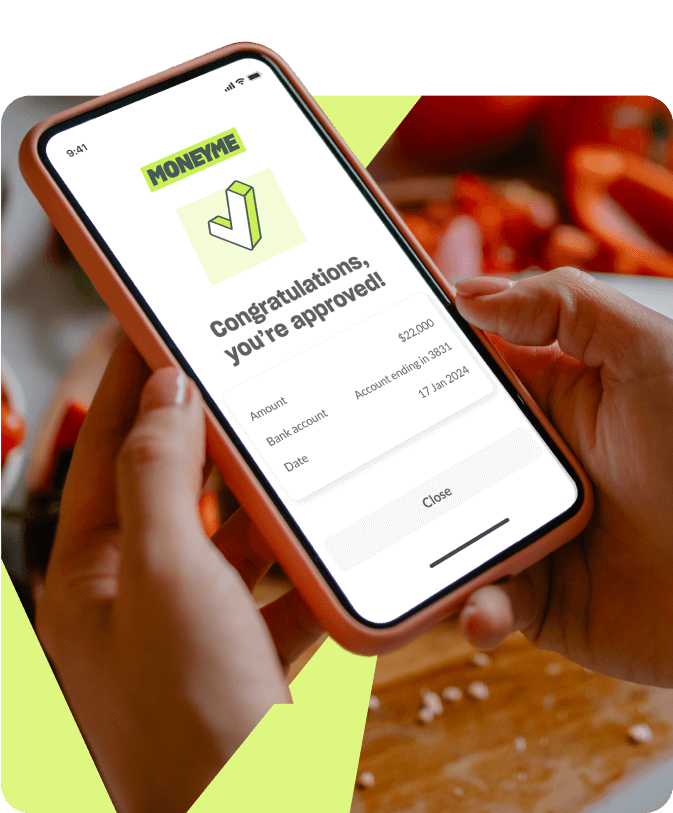

Applying for a fast online loan with us takes you just minutes. Our online application form has been specifically designed to offer you a fast, hassle-free and intuitive application process that often returns a response within the hour when you apply during our business hours. If you’re happy with the loan offer that we have made you then it’s simply a cash of digitally signing your loans contract and returning it online. Once we have received your signed contract then we transfer your new funds directly to you immediately. Some banks will even clear your funds the very same day which means that you could apply for, get approved for and receive the money you need all within the same 24 hours when you apply for credit with MoneyMe, Australia’s online money lender committed to delivering a fast, no bull and painless way of borrowing money immediately.