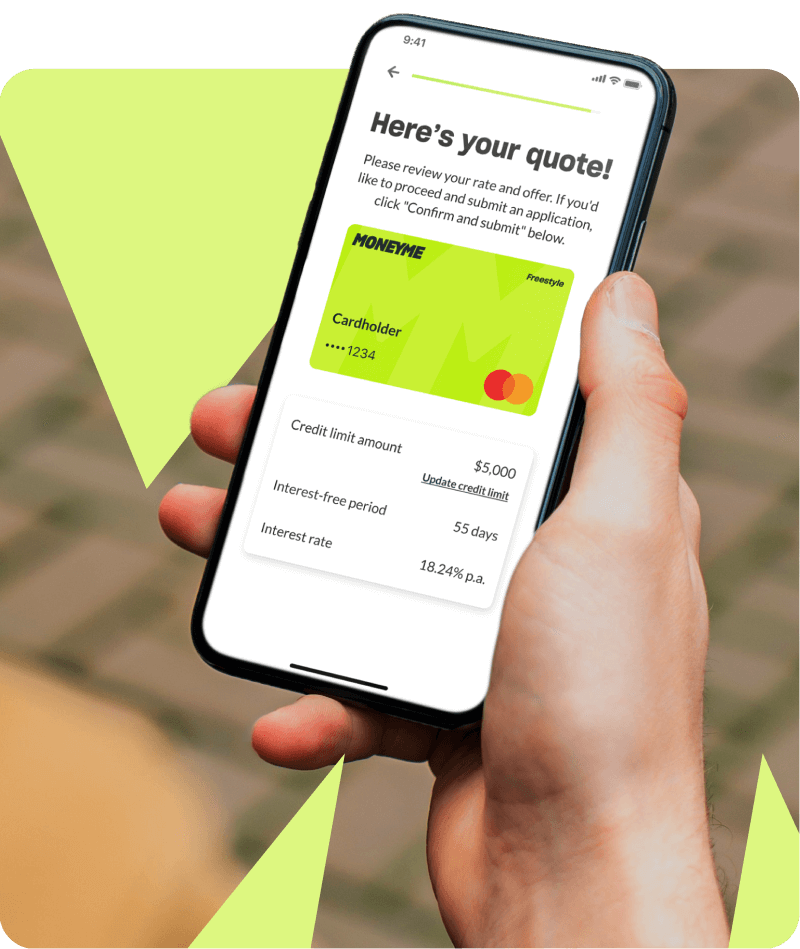

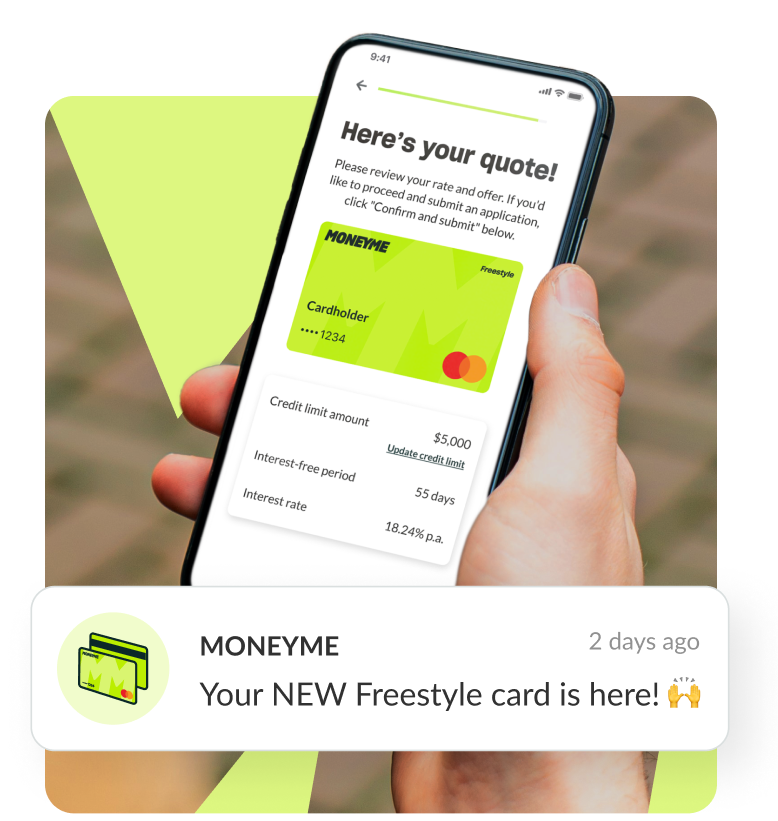

MoneyMe offers customers a quick online application process and fast approvals for a line of credit Perth customers can leverage to access hassle-free credit whenever they need it. We are an Australian accredited lender, but we like to do things a little differently to make accessing finances simple and easy for our customers.

We're an online-only company, so the first benefit to our customers is that there's no unnecessary paperwork involved in getting your loan approved or even applying; everything is completed right on our website from the convenience of your own home. Unlike traditional personal loans, where you pay off over time at set intervals each month, a line of credit provides access to more monetary help whenever it’s needed within one single limit amount that can be increased if required.

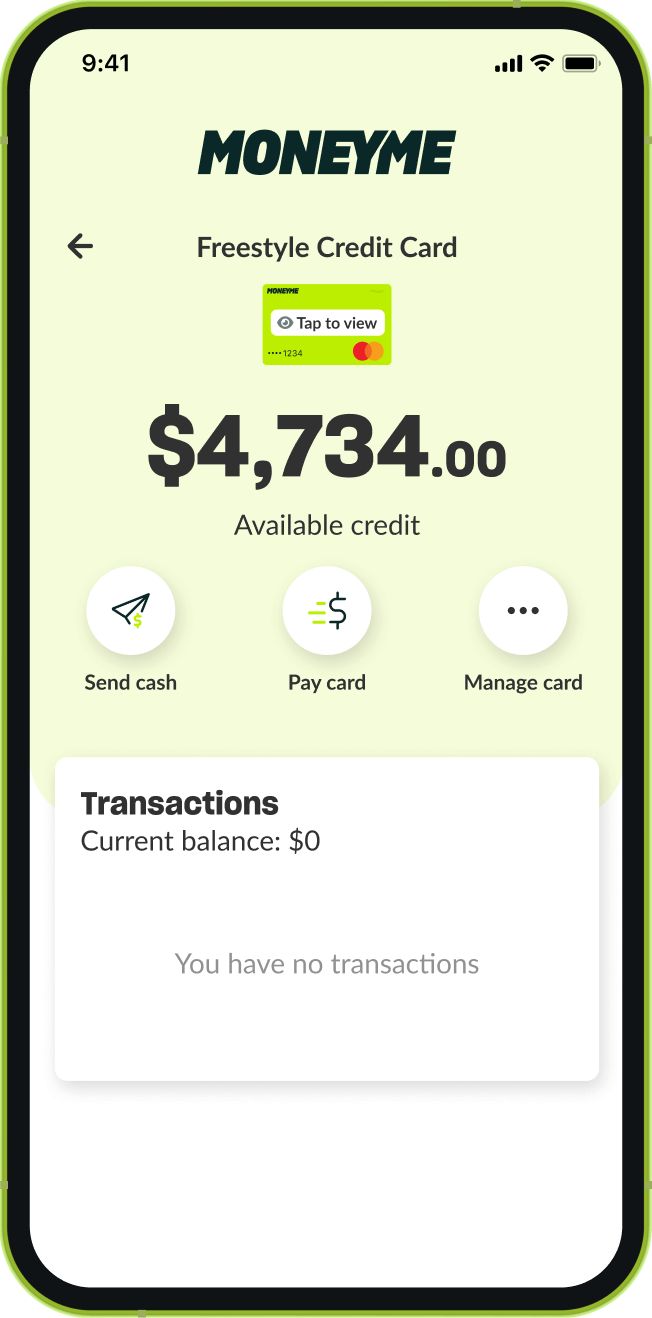

Compared to other types of loans where you might have to wait weeks before you get your next payment from an instalment plan, a line of credit will give you money as soon as you need it and however much of it you need to access, like in case of emergencies. A line of credit is a type of revolving loan that lets you access funds anytime, anywhere, and are typically either secured lines of credit or unsecured lines of credit. It’s never been easier to apply for a line of credit Perth customers can start enjoying fast.

Secured lines of credit are backed by collateral – which means you need to secure your line of credit against your personal assets, such as your home equity, car, or another type of financial asset. The lender has the right to seize the asset if you fail to repay your line of credit, which is why the interest rates are typically lower.

On the other hand, an unsecured line of credit is not backed by any asset. Since there is no collateral involved, it usually comes with higher interest rates to pose lesser risks to the lender.

At MoneyMe, we are excited to be offering an accessible line of credit Perth customers can use when they need it, however they need to access it.