If you need $5,000 immediately, another alternative to applying for a $5,000 personal loan is to get the MoneyMe Freestyle Virtual Mastercard®. This online credit card is stored on your smartphone and can be used at any place that accepts a Mastercard. Applying for a credit card that offers up to 55-day interest-free is quick and easy and it’s all done online. Once your virtual credit card has been approved you’ll have quick access to fast, reusable loans just like a line of credit up to $20,000. You can shop online, Tap n Pay in-store or send the money straight to your bank account. MoneyMe is all about offering our customers fast and tech-friendly experiences across our whole suite of personal loans and credit options. And, although MoneyMe is a 100% online business, our support team is available to help you 7 days a week via phone, email or LiveChat.

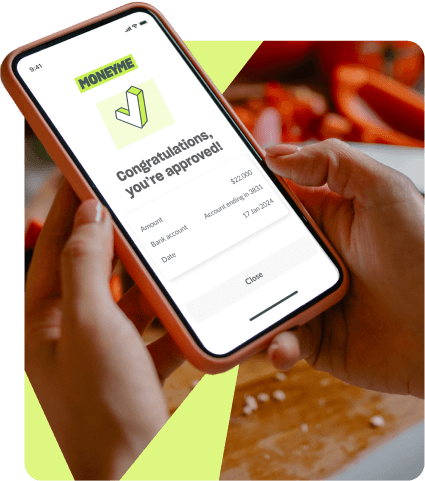

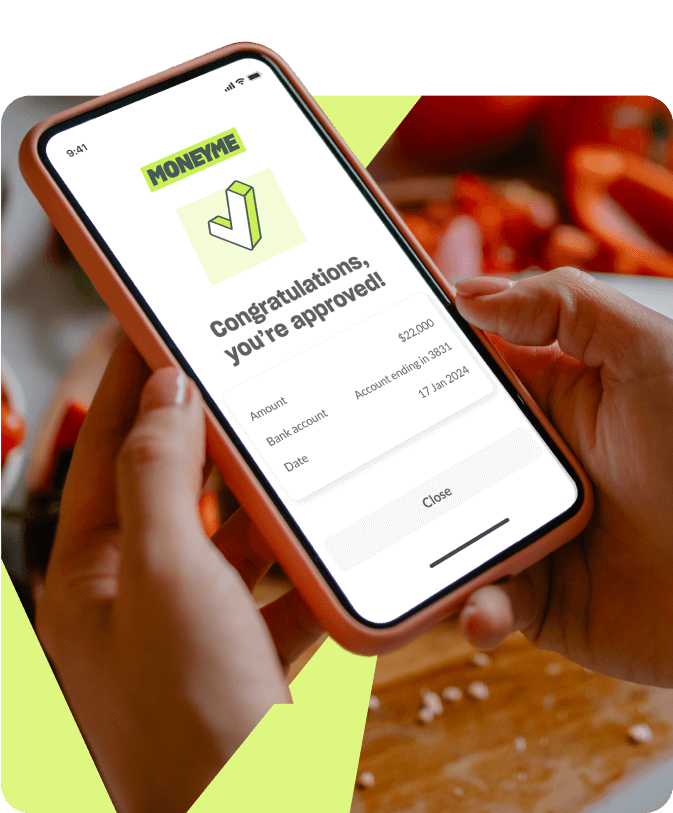

We know that with quick cash loans, time is of the essence. If you take out a $5,000 personal loan with MoneyMe, with their super quick application process, it will only take you a few minutes to apply online. Rather than needing to wait around for several hours, or even weeks, to see if your application has been successful, we use the latest in financial technology so we can give you a fast outcome. Depending on the time of day and which bank your account is with, you could have the funds in your account in as little as 60 minutes. If not, the funds will usually be accessible in the next business day. You’ll then be able to access the Member’s Area, which is your own personal loan dashboard online, where you’ll be able to monitor and manage your $5,000 personal loan details.

Whether you need a $5,000 personal loan, a $20,000 personal loan or a $30,000 personal loan, MoneyMe offers personal loan options ranging from small loans of $5,000 to large loans up to $50,000. With MoneyMe, instant loans are made easy. Apply online today, and you’ll have your $5,000 personal loan in your bank account even before you know it!