How could our range of easy finance help you right now? How could a quick loan from MoneyMe help to free up your cash flow, or assist in managing bills and debts you have?

If you’re moving to a new rental property then relocating is not only a stressful time, it can also be an expensive one. As a rental tenant, there are professional cleaning costs, possibly gardening costs, removalist costs and then the bond amount and upfront rent you have to pay for your new rental home. A short term loan from MoneyMe can be the quick cash you’re looking for to get rid of all of your upfront costs and then comfortably repay them over a period. You can stress less while you move and focus on the good parts of relocating like furnishing your new home and settling into a new neighbourhood.

Unexpected bills usually hit at exactly the wrong time and sometimes your savings just isn’t enough to cover everything cleanly or you’d rather not clean out your entire savings in one fell swoop. Whether it’s a long term personal loan that you need to cover things like medical expenses and mechanical costs or a new car, or small loans to help you clear off your utility bills, car registration and a few other odds and ends, we can help. Our range of easy loans offers you instant upfront cash so you can pay what you need to pay and still have some breathing space and a bit of savings at the end.

Having trouble saving for the things that you love, or have you come across a great deal that you just can’t pass up? Don’t put off the things on your bucket list and clear out your rainchecks. It’s time to start really living your life. Our quick personal loans can help you plan that holiday you have been promising yourself or finally do that world travel plan you and your best friend promised you’d do in high school. If you’re heading back to the books, we can help you with a fast cash loan to cover your education expenses. Our loans cover adult education and university, as well as kids’ school fees for college. Usually, courses offer you great savings when you’re able to pay upfront so why not take advantage of those early booking specials and access the quick loans you need from MoneyMe.

Been putting the wedding off so you could finally plan that dream even you’ve always wanted? Let us help you push the schedule forward. Need to update your bathroom or put on an extra room in the house? Apply for renovation loans and get the ball rolling.

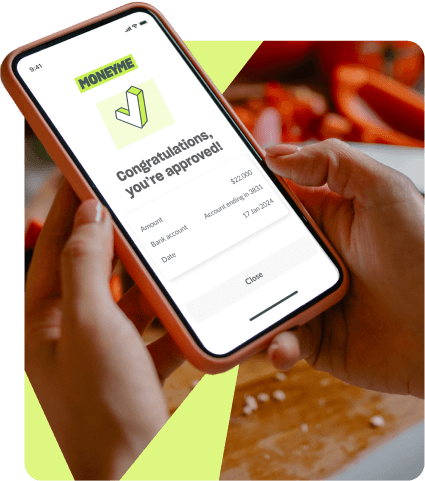

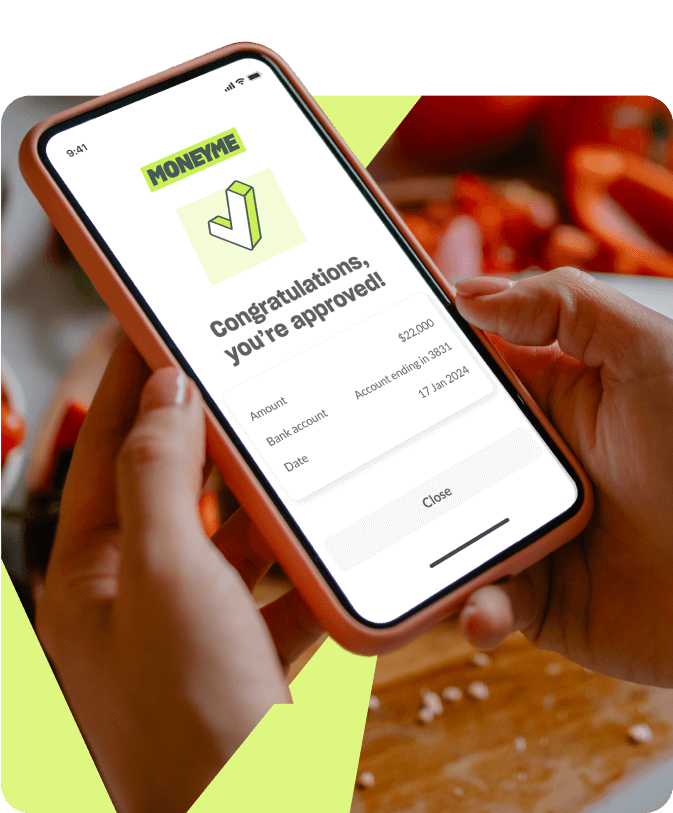

When you’re ready to proceed, apply online for quick personal loans with MoneyMe. Applications take you just a few minutes to complete and approvals are fast. Apply online today and get the cash you need from MoneyMe at great rates and low fees.