About MONEYME

Click on a category to see options

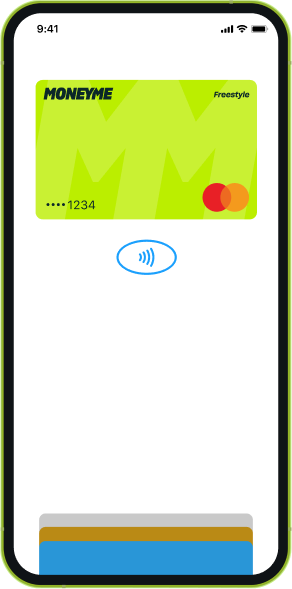

Freestyle Credit Card

100% digital. Available in minutes, not days.

A credit card designed for today with up to 55 days interest-free1 and zero-fee options.

- Showing results for

Credit card

A digital credit card for everyday

Up to 55 days interest free

Get up to 55 days interest-free on credit card purchases

Tap, shop and transfer

Tap & pay in-store, shop online or transfer to any bank account

Ready to use in minutes, not days

Your credit card can be approved and ready to use in minutes

100% digital, zero plastic waste

All the things you need from a credit card, without the plastic

Interest free days and zero fee options

Enjoy more flexibility with up to 55 days interest free on everyday purchases.

Interest free days and zero fee options

Enjoy more flexibility with up to 55 days interest free on everyday purchases.

Get a credit card in just a few steps

Get your credit card offer and check your credit limit and interest rate before you apply. It takes just a few minutes and won't impact your credit score.

Apply in minutes

Apply for a Freestyle Credit Card online or via the

MONEYME app. Keep your driver's licence ready

to verify your account.

Choose a credit limit

Get your credit offer and choose a credit limit from

$1,000-$10,000 to suit your needs.

Add to your mobile wallet

Activate your Freestyle Credit Card to start spending

immediately, once approved.

Like any credit card, just 100% plastic free

Use your Freestyle card to Tap ’n Pay or shop online anywhere Mastercard is accepted.

A different kind of lender

Quick quotes, fast approvals

We cut out unnecessary paperwork and delays with lending that's fast, simple, and built around you.

Transparent and flexible

No lock in contracts, hidden fees or surprises - just flexible options that keep you in control.

Real support, real fast

Speak to a real person if you have questions, we usually answer calls in seconds.

For people and the planet

We care about our social and environmental impact, and we're proudly B Corp Certified.

A credit card for

everyday

When life throws the unexpected your way, the MONEYME credit card is designed to adapt to your needs. Whether you're covering an urgent repair, managing a surprise expense, or simply keeping your financial options open, MONEYME is the credit card Australia trusts for modern spending in a digital world.

With solutions like our Freestyle Virtual Credit Card for access in minutes to funds, or a flexible line of credit up to $10,000, MONEYME empowers you to live in the moment without missing a beat. From interest-free credit card options to fast approvals and secure online credit card applications, we make it easy to seize opportunities and manage your money.

Explore the future of virtual credit cards - tailored to your lifestyle. Apply for a credit card today with MONEYME and experience smarter, faster, better credit.

Award-winning lender

Trusted by over 110,000 Aussies

What is a credit card?

A credit card is a versatile financial tool that empowers you to manage your money with flexibility and ease. Unlike debit cards, which draw funds directly from your bank account, credit cards provide access to a line of credit you can use for purchases, allowing you to pay later, often with the benefit of an interest-free credit card period

Credit cards offer practical advantages, from building your credit history to safeguarding your transactions with added security features. Many credit cards also come with perks such as rewards programs, travel benefits, and purchase protection, making them a smart choice for everyday expenses or larger investments.

Whether you're looking to finance urgent needs, explore virtual credit cards for modern convenience, or simply enjoy greater financial freedom, credit cards can enhance your spending power while keeping you in control.

Credit card vs a bank card

While both credit and bank cards are staples of modern spending, their key differences offer distinct benefits. A bank card, also called a debit card, accesses money directly from your bank account. It’s a straightforward tool for managing everyday expenses without accruing debt.

On the other hand, a credit card provides a revolving line of credit, allowing you to spend within a set limit and pay later. Beyond convenience, credit cards can offer valuable perks like purchase protection, travel benefits, and opportunities to build your credit score.

Considering fees, repayment terms, and your spending habits can help you decide which option best supports your financial goals.

Purpose-driven

and responsible

At MONEYME, we're not just here to provide low rate loans - we're here to make a difference. We believe in providing smart, responsible lending that keeps you financially on track, whilst doing good for the planet.

As a Certified B CorporationTM we're big on sustainability. We hold ourselves accountable to the high standards of the B Corp movement, supporting renewable energy projects, doing our part for the community, and striving towards a greener future.

Explore our impact

Frequently asked questions

1Conditions apply to the interest free period. Refer to the Terms and Conditions for the Account for further information. After the interest free period, an interest rate of 18.74% p.a. to 23.74% p.a. will apply.

2The actual rate that you receive will depend on a range of factors, including your credit score.

3Applications and maximum credit limits are subject to eligibility criteria including credit approval. Other terms and conditions may apply.